Artificial intelligence (AI) is now at the heart of growing tensions between the U.S. and China, as both nations push to secure leadership in the next era of technology. At the heart of this geopolitical and technological contest sits Nvidia, the world’s most valuable chipmaker and a critical supplier of the hardware that fuels today’s most advanced AI systems.

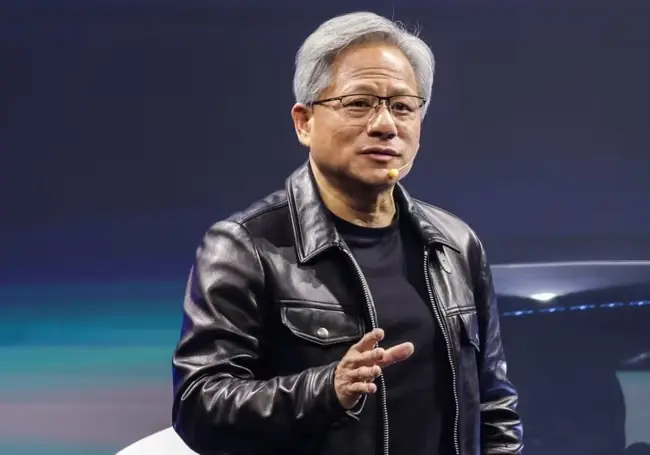

According to Reuters, Nvidia CEO Jensen Huang is set to host a media briefing in Beijing on July 16, marking his second high-profile visit to China in just three months. The visit comes at a sensitive time, both economically and politically, as Nvidia continues to navigate escalating scrutiny from U.S. lawmakers while trying to preserve access to one of its most important markets.

Nvidia AI Chips

Nvidia’s advanced graphics processing units (GPUs), particularly those built for large-scale AI model training, have become extremely valuable for modern machine learning infrastructure. Chips such as the H100 and its China-compliant counterpart, the H20, are widely sought after not just by technology companies, but also governments and defence sectors.

Why, you may ask? Well, Nvidia’s H100 chip is one of the most advanced processors currently available for high-performance computing. It's primarily used to train complex AI models that require significant computational resources. Due to its capabilities, many organisations rely on its large-scale data processing.

In response to U.S. export restrictions, Nvidia created the H20, a scaled-down version of the H100 that meets regulatory requirements for sales to China. While the H20 isn’t as powerful, it’s still suitable for running already-trained AI models—commonly referred to as inference. This makes it valuable for companies that need efficient deployment rather than cutting-edge performance.

Despite limitations, demand for the H20 remains strong, partly due to Nvidia’s proprietary CUDA software, which many Chinese companies rely on for building AI applications.

US Security Concerns

The concern from the U.S. side is that these powerful chips can accelerate China’s military modernisation and intelligence capabilities. Since 2022, the U.S. government has imposed successive waves of export controls on Nvidia’s most advanced chips, citing national security risks. The H20, which was once Nvidia’s most powerful AI chip, allowed for Chinese markets, was banned earlier this year.

Despite these restrictions, demand from China remains strong. In the fiscal year ending January 2024, Nvidia generated $17 billion in revenue from the Chinese market, 13 per cent of its total global sales.

The main appeal lies in Nvidia’s CUDA software platform, which allows developers to build and scale AI applications efficiently. This ecosystem lock-in makes Nvidia chips difficult to replace, even as domestic competitors like Huawei push forward with their own alternatives.

Nvidia CEO's Visit Fuels U.S. Concerns

Huang’s upcoming visit to China has triggered fresh concern among U.S. legislators. In a bipartisan letter issued on July 11, 2025, Senators Elizabeth Warren and Jim Banks urged Huang to avoid any meetings with Chinese entities linked to military or intelligence agencies. The senators also warned against interactions with firms listed on the U.S. Department of Commerce’s restricted export list.

The move reflects a broader shift in U.S. policy where AI hardware, previously seen as commercial technology, is increasingly treated as a strategic asset. Proposed legislation would require AI chip companies like Nvidia to verify the end-user location of their products to prevent misuse or export restrictions.

Inside Alibaba Qwen’s Agent Bet

How Qwen3.5 shifts from chat UI to execution layer, redefining where agents fit in enterprise workflows and CIO AI investment plans.

A recent report added further fuel to these fears, revealing that Chinese AI firm DeepSeek had allegedly supported military efforts through shell companies that bypassed U.S. controls. The risks around AI hardware proliferation are not hypothetical—they are already unfolding in the shadows of global supply chains.

Nvidia’s Balancing Act

Nvidia’s position is something no organisation should be put in the middle of. On one hand, its technology is integral to the global AI boom, and its market cap now exceeds $4 trillion. On the other hand, it must carefully tread a line between national interests and shareholder value.

In a CNN interview aired on Sunday, Nvidia CEO Jensen Huang downplayed concerns about U.S.-made technology being used by China's military. He stated that such reliance is unlikely, as “they simply can’t rely on it.”

Huang pointed out that access to U.S. tech could be cut off at any time, making it an unstable foundation for military use.

“There’s already significant computing power within China. They don’t need Nvidia chips—or American technology stacks—to build their military capabilities,” he said.

Nvidia has also adapted its business strategy to comply with U.S. export laws, developing modified chips for the Chinese market. However, even these adapted products—like the H20—are not immune to policy reversals. According to Huang, recent restrictions could slash Nvidia’s China revenues by as much as $15 billion.

To mitigate further losses, Nvidia is reportedly planning to launch a lower-cost version of its flagship Blackwell AI chips tailored for China. It’s a stop-gap measure, but not a long-term solution in a market that continues to shrink under geopolitical strain.

To learn more watch this video:

Inside the New Edge Stack

Compare ten leading edge platforms from cloud, hardware and open-source vendors, and see how they extend Kubernetes, AI and data services on-site.

Comments ( 0 )