We constantly reach for our phones, bombarded by a barrage of texts. Between work messages, social updates, and friendly check-ins, it's easy to let your guard down. But within this constant flow of texts lurks a hidden threat: smishing scams.

In this article, we will explore the meaning of smishing, give examples, define the difference between smishing and phishing, and delve into how to defend against it.

What is Smishing?

Smishing is a type of cyber attack that uses text messages to try to trick you into giving away personal information or clicking on malicious links.

People smish, or carry out smishing attacks, for one main reason – financial gain. They aim to steal personal information they can exploit for various criminal purposes.

People are more likely to click on links in texts compared to emails, making them a vulnerable avenue for cybercriminals to exploit. Smishing messages also often create urgency or panic, like claiming your bank account is compromised, tricking people into acting fast without thinking critically.

Read: Top 10 Facts About Smishing and How to Defend Against it

By spoofing messages to appear from familiar sources (banks, delivery services), smishing attacks prey on people's trust in these legitimate entities.

Compared to more complex hacks, smishing requires less technical knowledge, making it accessible to a wider range of criminals.

Smishing Examples

There are many different versions of smishing messages but they all try to manipulate you in similar ways. These often evolve to have the maximum impact, such as during the COVID-19 pandemic, there were many reports of smishing messages offering tests, Covid results and even cures in an attempt to steal personal information or spread malware.

The most common smishing examples to watch out for are:

1. The Fake Delivery Notification

A text message supposedly from a delivery company (FedEx, DHL, etc.) claiming a package delivery attempt was missed. It includes a link to "reschedule" delivery, which could lead to a malware download or a fake website designed to steal your credit card info.

- The Bank Alert Scam: This message pretends to be from your bank, warning of suspicious activity on your account. It urges you to "verify" your information by clicking a link, leading to a phishing site designed to steal your login credentials.

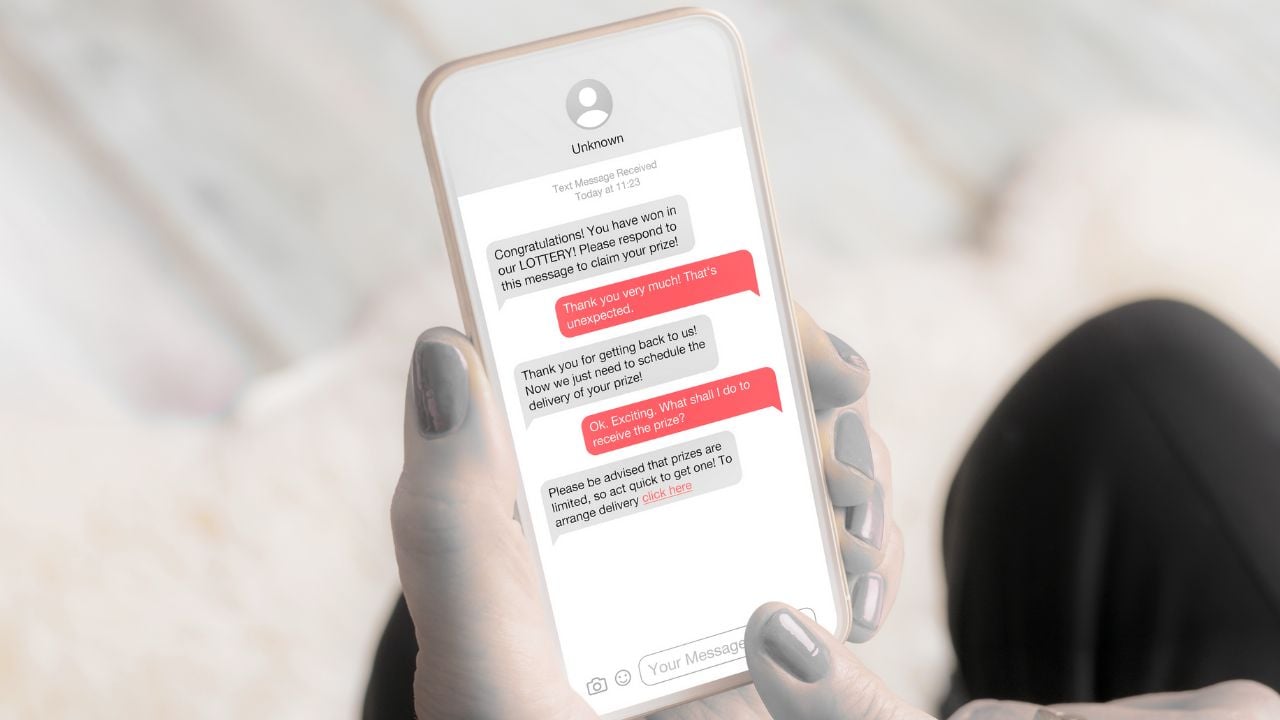

- The Phony Raffle Win: This enticing message congratulates you on winning a prize or sweepstakes. It includes a link to "claim" your reward, but clicking it might install malware or take you to a fake website requesting your personal details.

- The Urgent Password Reset: The message claims to be from a social media platform or online service, stating your password needs immediate reset due to suspicious activity. Clicking the link could lead to a fake login page where you unknowingly surrender your password.

- The Tax Season Ploy: During tax season, smishing messages might pose as the IRS or tax agency, threatening you with fines or promising a large refund. They pressure you to click a link to "verify" your information or claim your refund, potentially leading to malware or a fake website for stealing your personal data

Smishing Vs Phishing

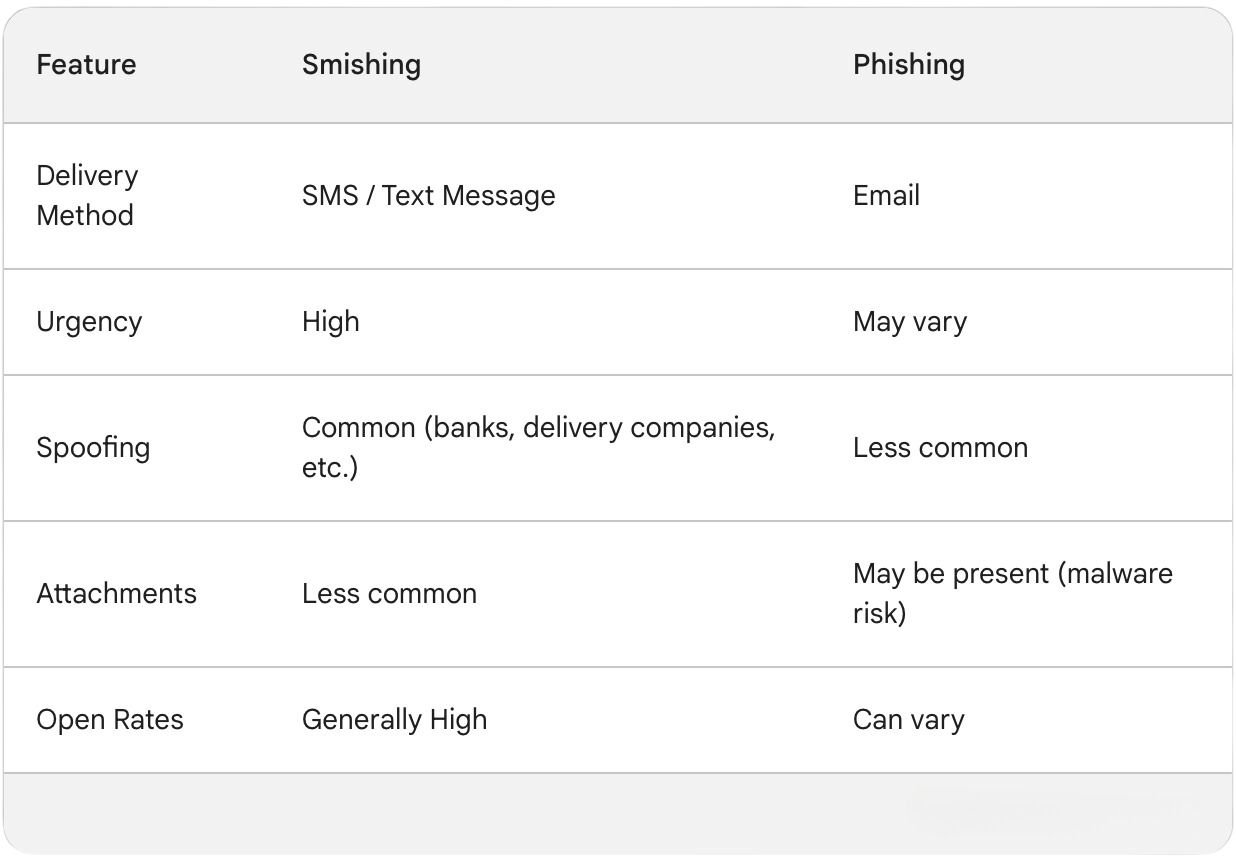

Smishing and phishing are both social engineering attacks that aim to steal personal information, but they differ in how they reach their victims.

Smishing often relies on a sense of urgency or panic to pressure victims into clicking links or responding quickly. They may spoof messages to appear from familiar sources like banks or delivery companies.

Phishing can be more elaborate, with attackers crafting believable emails that appear to be from legitimate companies or institutions. Phishing emails may also contain attachments that can harbor malware.

Smishing leverages the high open rates and immediacy of text messages to reach a broad audience whereas phishing casts a wider net with emails, but may have a lower success rate due to people being more cautious about opening email attachments or clicking on suspicious links in emails.

How to Prevent Smishing

Don't click on links in suspicious texts. Smishing messages often rely on urgency or curiosity to trick you into clicking a malicious link. If you're unsure, don't click!

Be wary of any unsolicited text. Legitimate businesses typically won't contact you about urgent account issues or prizes via text message. Treat any unexpected text with caution.

Verify information directly. If a text message claims to be from your bank, credit card company, or any other institution, contact them directly using a phone number you know is correct (look it up on their official website). Don't use phone numbers or links provided in the text message.

Enable multi-factor authentication, this adds an extra layer of security to your online accounts, making it much harder for attackers to gain access even if they steal your password through smishing.

Install security software that can help identify and block malicious links or phone numbers associated with smishing scams.

By raising awareness about smishing tactics, you can help protect yourself, your family, and friends from falling victim to these scams.

Comments ( 0 )