Banking looks very different today than it did 30 years ago. Gone are the days of making daily cash withdrawals, cashing in cheques, or even visiting the bank at all.

While many customers continue to conduct at least some of their business at brick-and-mortar banks, banking is turning increasingly digital. A 2023 study by Accenture found that just under half of them have gone online or digital only. And this trend is only expected to grow.

With mobile apps and online banking platforms offering easy access to accounts and services, physical branches are losing their influence in the banking world.

At the forefront of this shift are several leading online and digital banks whose incredible user experience is making it easier than ever before for people to manage their money remotely.

What are digital banks?

Digital banks are financial services companies that operate exclusively online. They offer many of the same services as physical banks but through a mobile app or website.

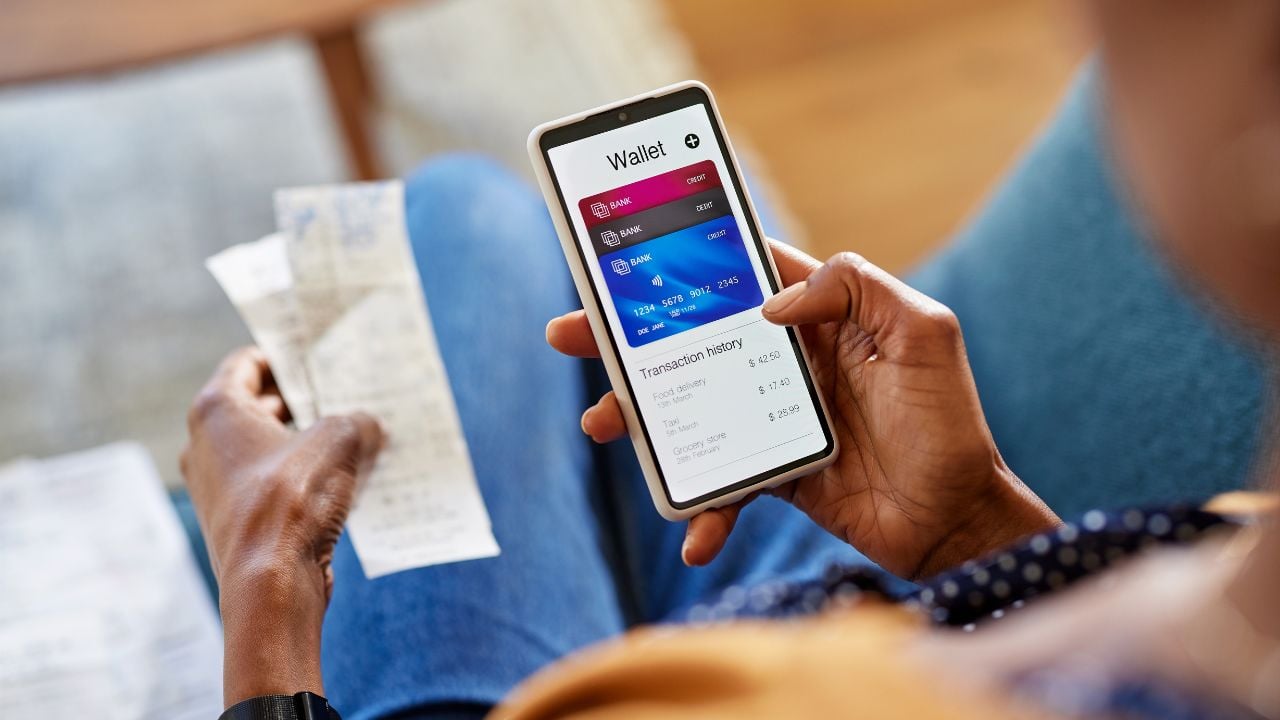

Digital banks typically don't have any physical branches. Instead, they put all of their resources into mobile banking, offering user-friendly mobile apps that allow customers to manage their accounts, transfer money, and invest directly through the bank’s app.

Digital banks operate through a network of servers and databases that store customer information and transaction data. Customers access their accounts and manage their finances through the bank's website or mobile app.

Some digital banks also allow you to submit applications for loans and credit cards directly through the bank's app or website. Others even offer investment services, such as the ability to buy and sell stocks, bonds, and mutual funds, and budgeting tools to help you plan your finances.

Benefits of Digital Banking

One of the main benefits of digital banks is that they’re much more convenient than physical banks since you can access your bank whenever and wherever you want as long as you have access to the Internet.

This means you can transfer money, check balances, and manage your accounts anywhere in the world without the constraints of traditional banking hours.

Since digital banks operate without physical branches, they also avoid much of the costs associated with maintaining a branch network. This allows them to pass on the cost savings to customers in the form of lower fees, higher interest rates on savings accounts, or other competitive features.

It’s also important to note that digital banks often offer a better user experience than traditional banks. Opening an account is often extremely simple, and you don’t need to fill in any paperwork, sign any documents or even leave the comfort of your own home.

When Cyber Risk Halts Cash Flow

MoneyGram’s outage exposes how a single breach can freeze global remittances and test incident response and continuity planning at scale.

Things to consider before using a digital bank

While digital banks offer numerous benefits, it's important to consider that digital-only banks lack many of the banking services you may rely on.

For one, digital banks often have little to no ATM networks, so you may need to use ATMs from other banks which may incur additional charges. They also have no or very few physical branches, so if are looking for in-personal financial advice, they may not be the best option for you.

Digital Banks don’t offer the full suite of financial services you may need. If you have diverse banking needs or require specialized services, an online bank may not be the most suitable option.

Choosing a digital bank

Choosing the best digital bank for your needs can be tricky, but with the right approach, you can find one that perfectly aligns with what you’re looking for.

Here's a breakdown of key factors to consider:

- Fees and charges – Compare monthly account fees, ATM fees, and foreign transaction fees. Some banks offer fee-free accounts with certain conditions.

- Interest rates – Check for competitive interest rates on checking and savings accounts, especially on high-yield savings options.

- Mobile app and online banking experience – Evaluate the user interface and functionality of the app and online platform. Ensure it's intuitive and convenient for your daily banking needs.

- Customer service – Research customer service options and reviews to see how readily available and helpful they are.

- Security and FDIC insurance – Ensure the bank uses robust security measures for your data and transactions, and verify if it's FDIC-insured to protect your deposits.

Inside 5G-First Finance Stacks

Explore the infrastructure shifts financial leaders need as 5G, cloud and real-time data converge to power new fintech services.

Best Digital Banks

There are a range of different digital banks on the market each with its own account types, price points, and set of features to help you track spending and make the most out of your hard-earned cash.

In this list, we’re counting down ten of the best digital banks available today, exploring the features and benefits that make them so popular.

Comments ( 0 )