Data has always mattered. What changed in 2025 is that enterprises stopped being able to treat data as a back-office concern that only showed up in analytics roadmaps and storage bills.

In one year, data became regulated, commercially mobile, central to generative artificial intelligence (AI), expected in real time, and far more accountability-heavy than most leadership teams were set up for. These were not abstract “data trends”. They were structural shifts that forced decisions across contracts, architectures, governance models, and risk ownership.

Just as importantly, data strategy stopped being owned by one function. Legal, procurement, platform engineering, security, and product teams all got pulled into the same room because the pressure was coming from multiple directions at once.

That is why 2026 planning already has constraints baked in. You are not designing a data strategy on a blank canvas. You are responding to a market that has moved, regulation that is now live, and an AI reality that depends on the state of your data more than the state of your models.

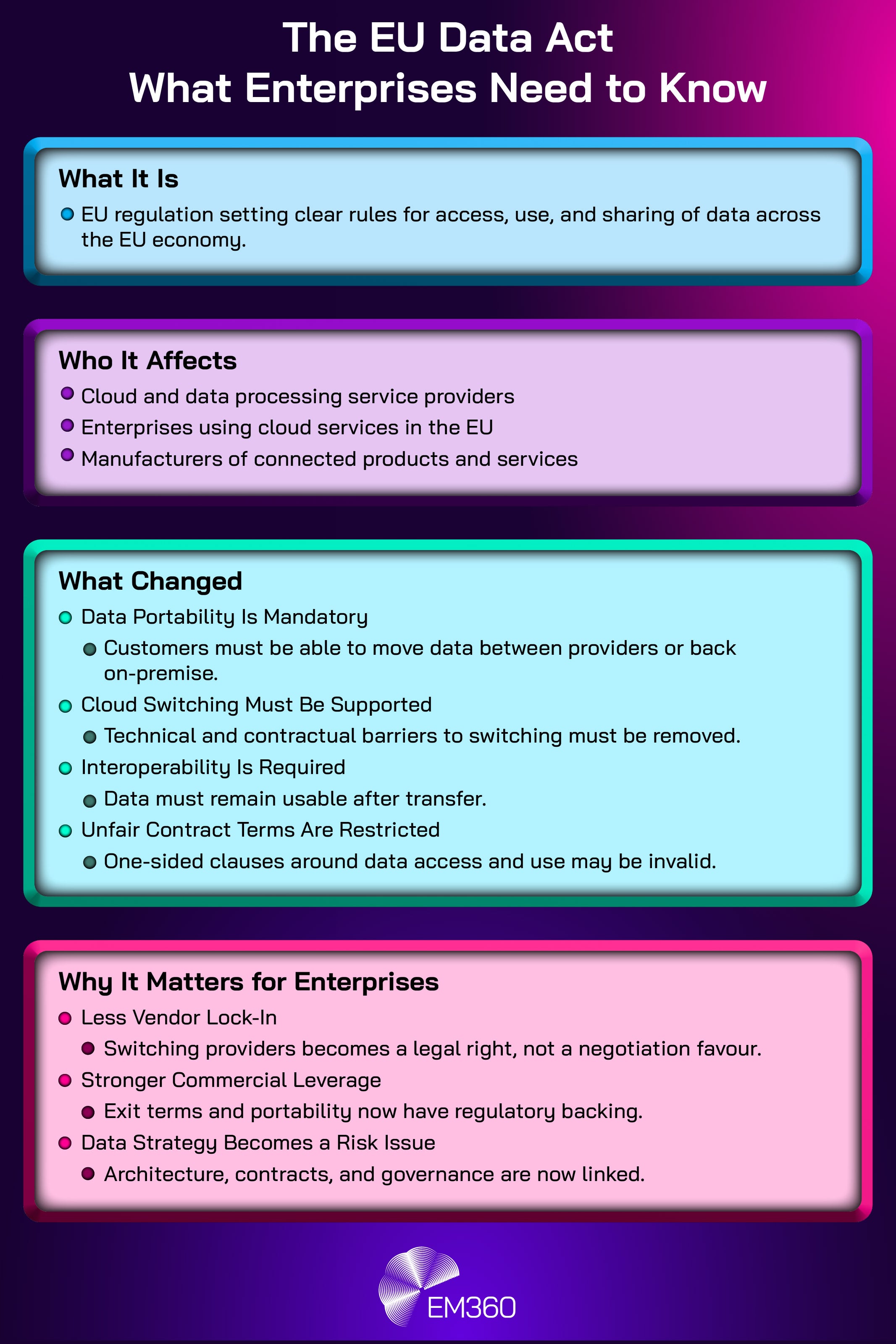

When the EU Data Act Turned Data Portability Into a Board-Level Risk

The EU Data Act became applicable on 12 September 2025, making new expectations around access, sharing, and switching enforceable across the market. That date matters because it turns portability from a “good practice” conversation into an operational requirement with real contractual impact.

For enterprises, the most disruptive part is not philosophical. It is practical. The Data Act pushes the market towards cloud switching and reduced vendor lock-in, creating pressure for interoperability and credible exit routes.

This is why the Data Act landed on the board agenda. If your business runs on third-party data processing services, you can no longer treat switching as a theoretical option that lives in a slide deck. It becomes part of commercial risk management, resilience planning, and regulatory posture.

How enterprises reacted in the moment

The first reaction was contractual triage. Contracts and renewal cycles that once focused on discounts and consumption commitments suddenly needed scrutiny for switching terms, portability obligations, and hidden dependencies.

That pulled procurement and legal into deeper technical conversations than they usually want. The “exit plan” stopped being a vague assurance and became a question that platform and data teams had to answer with specifics: what data can be exported, in what format, with which dependencies, and at what operational cost.

It also triggered a subtle shift in accountability. Once switching becomes a compliance and business continuity concern, ownership cannot sit solely with the data team. Executive leadership wants clarity on exposure, timelines, and cost, not just principles.

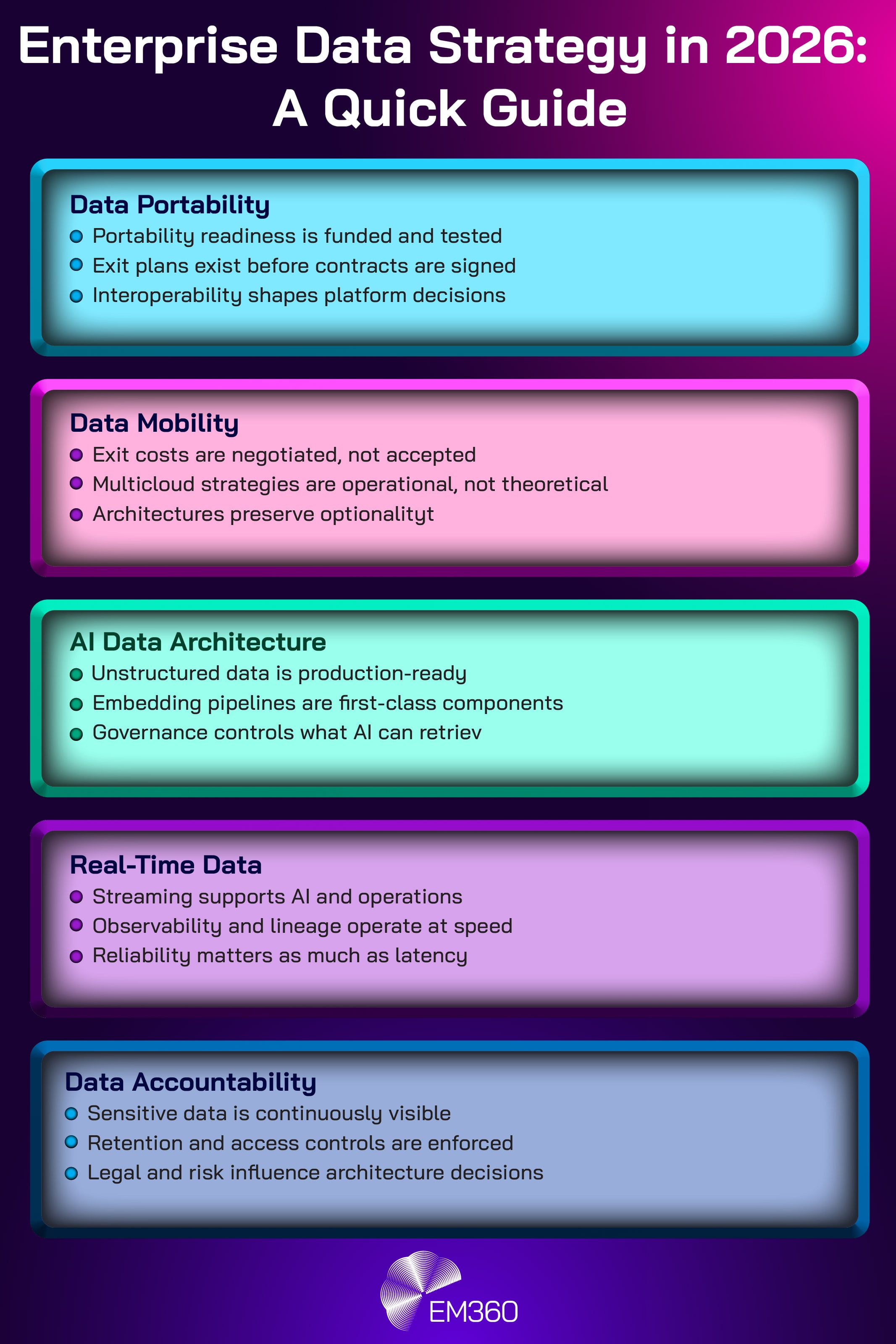

What data strategy looks like in 2026

In 2026, portability will show up as a funded capability, not a line in an architecture diagram.

Enterprises will budget for portability readiness, including data inventories, dependency mapping, and migration testing. Exit planning becomes standard practice because portability is no longer only about optionality. It is about being able to prove you can move without unacceptable disruption.

There is also a timing pressure that will shape 2026 behaviour. Deloitte notes that switching charges can be permitted until 12 January 2027, after which they are prohibited under the Data Act’s switching provisions. That makes 2026 a sensible year to pressure-test exit routes and negotiate from a position of preparedness rather than panic.

Cloud Exit Fees Became a Commercial Negotiation, Not a Technical Footnote

Once regulation put switching and portability under a brighter light, hyperscalers started adjusting commercial models in ways that signalled real competition.

When Platforms Betray Communities

How ownership changes, ad demands and moderation choices turned a creative social hub into a case study in misaligned platform strategy.

A clear example came on 10 September 2025, when Google Cloud introduced no-cost, multicloud Data Transfer Essentials for EU and UK customers. This was not framed as a quiet pricing tweak. It was positioned as a move that supports multicloud mobility, released just days before the Data Act became applicable.

Reuters captured the strategic undercurrent: when one hyperscaler drops certain transfer fees in a regulated environment, it turns data movement from an unavoidable penalty into a competitive lever.

How enterprises responded once leverage appeared

Procurement teams noticed immediately because the shift changes negotiation posture. When “data transfer is expensive” stops being a universal rule, enterprises can start asking sharper questions, both commercially and architecturally.

The practical impact is that multicloud conversations become less theoretical. If data movement costs can be reduced or waived in specific conditions, the enterprise can revisit what “optional” really means: optionality in platform choices, in resilience design, and in how much leverage you retain in renewal cycles.

Platform teams also get a clearer mandate. Mobility is not just a cost issue. It becomes part of vendor risk management and operational resilience.

What cloud and data decisions prioritise in 2026

In 2026, expect more formal “exit plans” to sit alongside contracts, not behind them.

Architectures will increasingly be assessed against a simple question: does this design preserve optionality, or does it deepen lock-in? That includes how data is stored, how much is tied to proprietary services, and how easy it is to move workloads without breaking upstream and downstream dependencies.

This is the point where data portability becomes a commercial strategy. Enterprises will treat mobility as a capability that can lower long-term risk and improve negotiating power, rather than a last-resort escape hatch.

Vector Data Pushed AI Data Architecture Into the Core Stack

If the Data Act and cloud pricing shifts changed the governance and commercial context, AI changed the technical definition of “data platform”.

Inside Snapchat’s GPT Layer

A look at how Snapchat’s My AI taps LLM infrastructure, user data and location signals to personalise interactions and monetisation.

In 2025, retrieval-augmented generation (RAG) and vector search accelerated from niche to mainstream. A key signal came from Amazon Web Services (AWS): Amazon S3 Vectors reached general availability on 2 December 2025, with AWS positioning it as production-ready for RAG, semantic search, and AI agent workloads.

This matters because it normalises vector data as “just another data type” that belongs in core data infrastructure decisions, not specialist side projects.

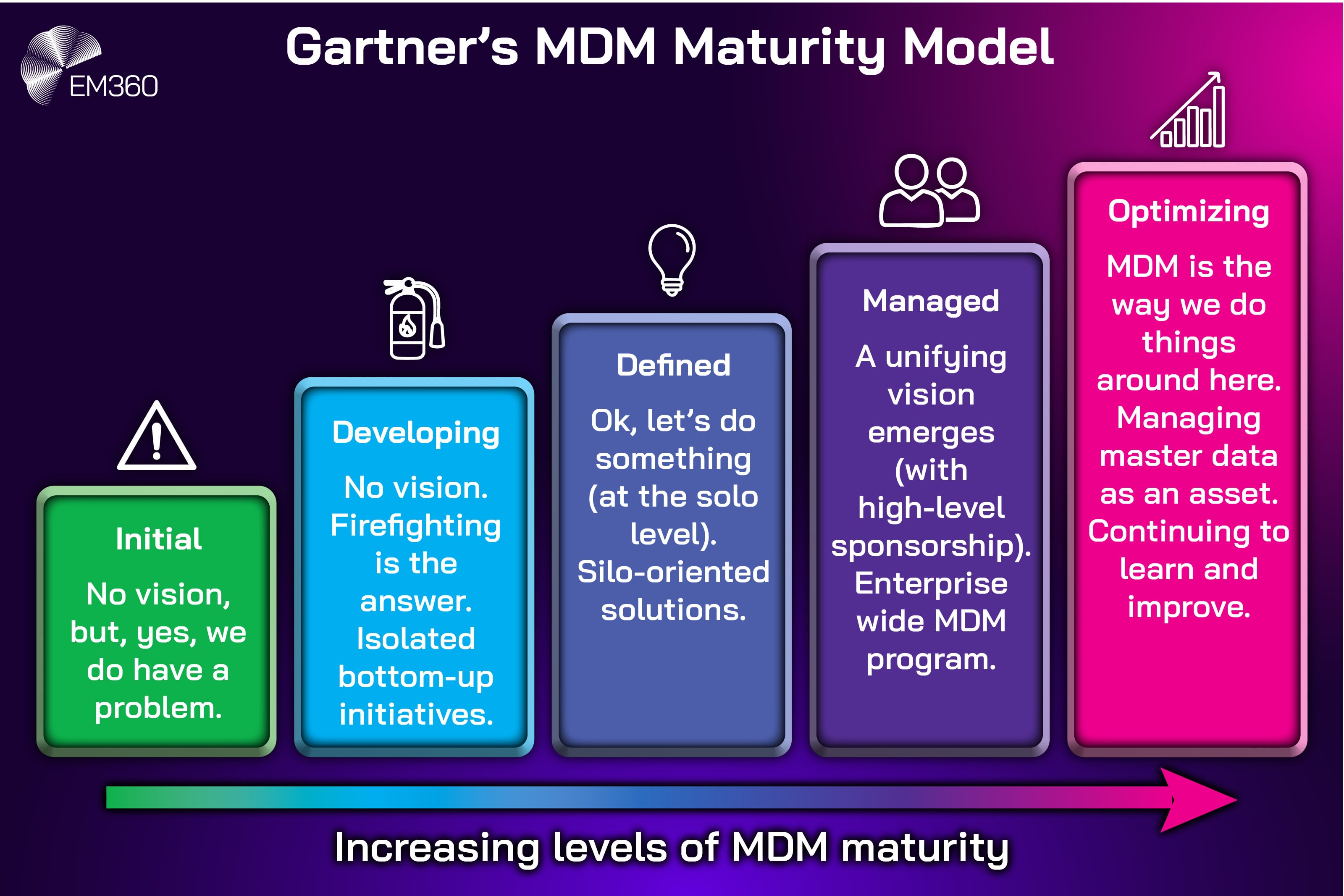

How enterprises adjusted their data priorities

When AI moves into production, data maturity becomes the limiting factor.

Enterprises quickly learned that model performance is only part of the story. If your knowledge lives across documents, tickets, contracts, and unstructured repositories, AI success becomes a question of how fast you can make that information usable, governed, and safe to retrieve.

That drives new governance questions that traditional BI did not need to answer: What should be embedded? What is off-limits? Who approves changes to a knowledge base that AI systems will query at scale? What controls prevent sensitive data from being surfaced to the wrong user, even if access controls exist elsewhere?

How data stacks are being rebuilt for 2026

In 2026, AI data architecture will not be a separate initiative bolted onto the side of a warehouse. It will be designed into the stack.

Expect embedding pipelines to be treated as first-class components, with governance controls that are explicit about retrieval and exposure risk. The question is no longer “can we do RAG”. It is “can we do RAG responsibly, repeatedly, and at enterprise scale”.

That shifts budgets towards unstructured readiness, curation, and governance for AI knowledge bases, plus the operational controls that make AI outputs auditable and defensible.

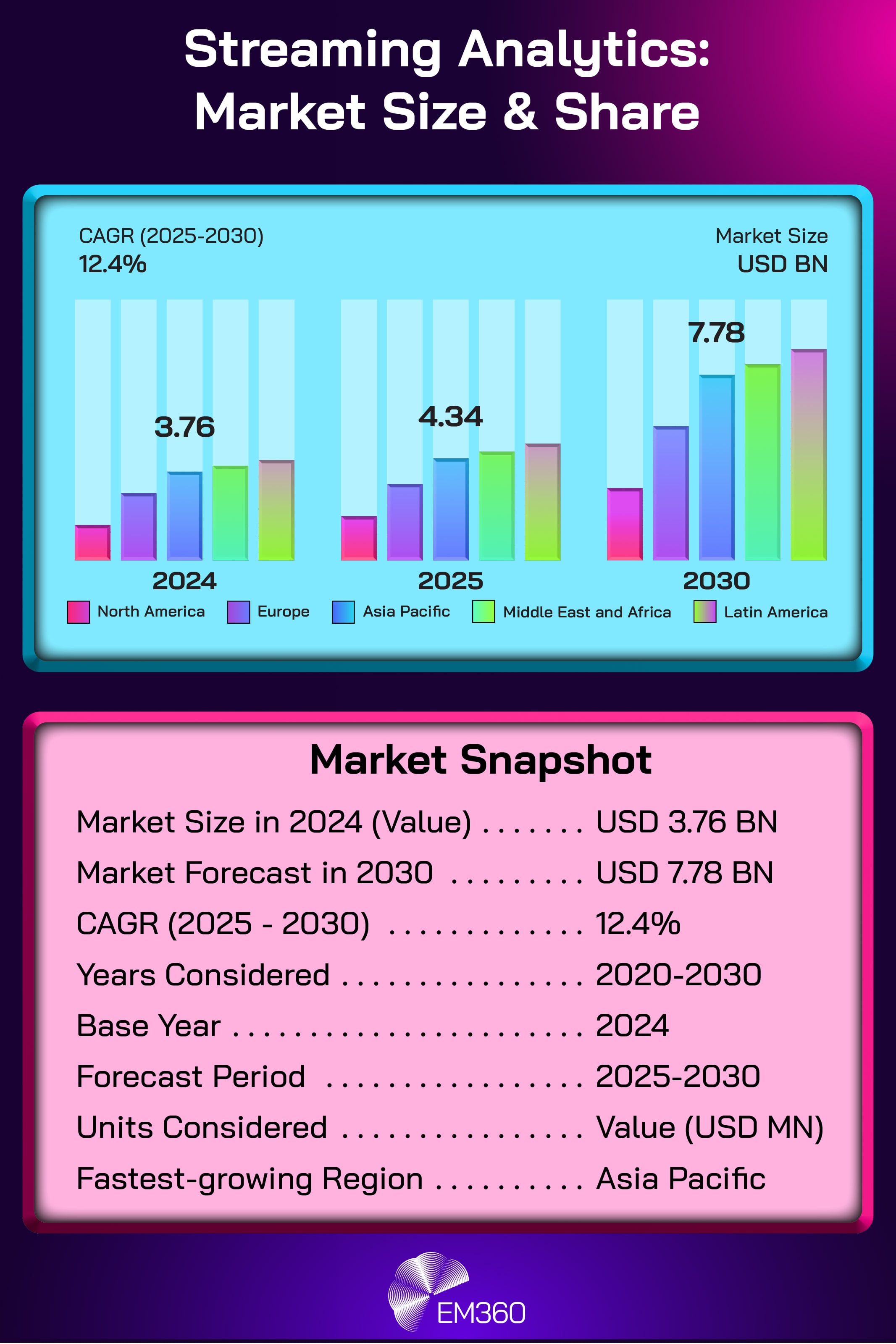

Real-Time Data Became the Default for AI and Operations

Batch pipelines still have their place, but 2025 reinforced a hard truth: AI and modern operations increasingly depend on current state.

Data Control Lessons from Google+

Uses the Google+ shutdown and Project Strobe review to explore privacy expectations, API governance, and consent in large-scale platforms.

A headline-level market signal arrived on 8 December 2025, when IBM announced plans to acquire Confluent in an $11 billion deal, positioning the move as part of building a data platform for enterprise generative AI. The deal is expected to close by mid-2026, which makes it a clean bridge into the 2026 planning lens.

The point is not that every enterprise needs to copy IBM. The point is that major vendors are placing long-term bets on streaming and real-time data as foundational to AI-era workloads.

The operational reality enterprises had to confront

Real-time makes problems visible faster, but it also makes them more dangerous.

When pipelines run continuously, data quality issues propagate instantly. Failures are not contained to a nightly batch window. They become business-facing incidents, and in AI use cases, they can become automated decision errors.

That is why real-time initiatives often stall in the same places: observability gaps, lineage blind spots, and unreliable integrations. You cannot govern what you cannot see, and you cannot trust a pipeline you cannot monitor.

What “real-time ready” means in 2026

In 2026, real-time investment will expand beyond streaming tech itself.

Enterprises will fund the guardrails that make streaming safe: monitoring, lineage, incident response, and governance that operates at speed. Real-time becomes infrastructure, which means it must meet infrastructure standards for reliability and accountability.

The winners will be the organisations that treat real-time as an operational discipline, not an innovation experiment. Speed without control is not agility. It is risk.

Data Accountability Shifted From Policy to Consequence

The final shift is the one that makes all the others harder to ignore: consequences have become more public, more expensive, and more leadership-level.

In December 2025, Reuters reported that South Korea’s Coupang suffered a breach affecting over 33 million customers, followed by CEO resignation and government scrutiny. That is not a “security story”. It is a governance story with visible accountability attached.

From Audits to Continuous Trust

Shift compliance from annual snapshots to embedded, automated controls that keep hybrid estates aligned with fast-moving global regulations.

At the same time, regulators continued to signal that data security failures will be enforced, even when the organisation involved is a security provider. The UK Information Commissioner’s Office (ICO) issued a £1,228,283 penalty against LastPass UK Ltd on 20 November 2025, relating to security failings that enabled exfiltration of personal data tied to approximately 1.6 million UK customers.

How enterprises responded under scrutiny

When incidents carry leadership fallout, enterprises respond by changing who gets involved.

Data governance shifts closer to executive risk management, not because leaders suddenly love data, but because they recognise exposure as a business event. That also increases scrutiny of suppliers and third parties, especially where sensitive data is processed outside direct enterprise control.

This is the moment where “policy paperwork” stops working. A policy does not prevent exposure. Controls do. Monitoring does. Architecture choices do.

How accountability reshapes data decisions in 2026

In 2026, accountability will push more enterprises towards continuous visibility into sensitive data, including where it sits, who can access it, and whether it is being retained longer than necessary.

Retention and access controls will be funded properly because they are no longer seen as compliance theatre. They are the difference between a contained issue and a headline event.

Audit, legal, and risk teams will also sit closer to data architecture decisions. Not to slow things down, but to ensure the organisation can defend its decisions when something goes wrong, which is increasingly the standard enterprise expectation.

Final Thoughts: Data Strategy Became a Leadership Responsibility

These five moments share a common thread: they moved data out of the background.

Regulation made portability enforceable. Market shifts turned mobility into leverage. AI pulled unstructured data and retrieval into the core stack. Real-time expectations raised the operational bar. Public consequences made governance impossible to ignore.

The 2026 challenge is not optimisation. It is readiness. Enterprises that still treat data as infrastructure, something that quietly supports other priorities, will struggle in a world where data decisions are simultaneously legal, commercial, operational, and reputational.

If you want to keep a clear view of what is changing and what it means for enterprise technology leaders, EM360Tech’s enterprise technology insights will keep tracking the moments that shape how organisations build, govern, and use data when the stakes are real.

Comments ( 0 )