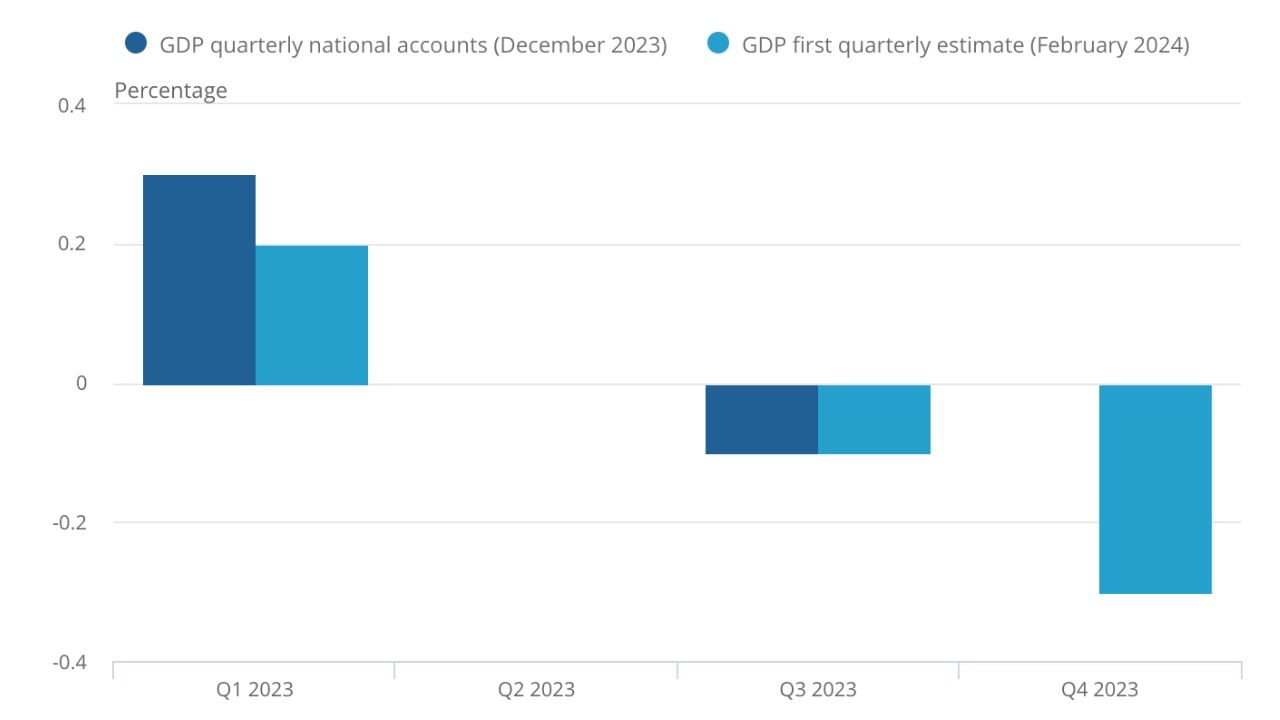

The UK has fallen into a technical recession following three months of economic downturn at the end of last year due to increased interest rates and reduced spending.

The Office for National Statistics revealed today that In the final months of 2023, Gross domestic product, which is a key measure of economic activity, dropped by 0.3% following a fall between July and September.

The economy recovered from that initial downturn, but the UK is considered to be in recession if GDP falls for two successive three-month periods – which it technically did.

According to ONS, for the whole of 2023, the economy grew by just 0.1%. And excluding years during the pandemic, this annual growth figure is the weakest since 2009 when the UK and major economies were reeling from the global financial crisis.

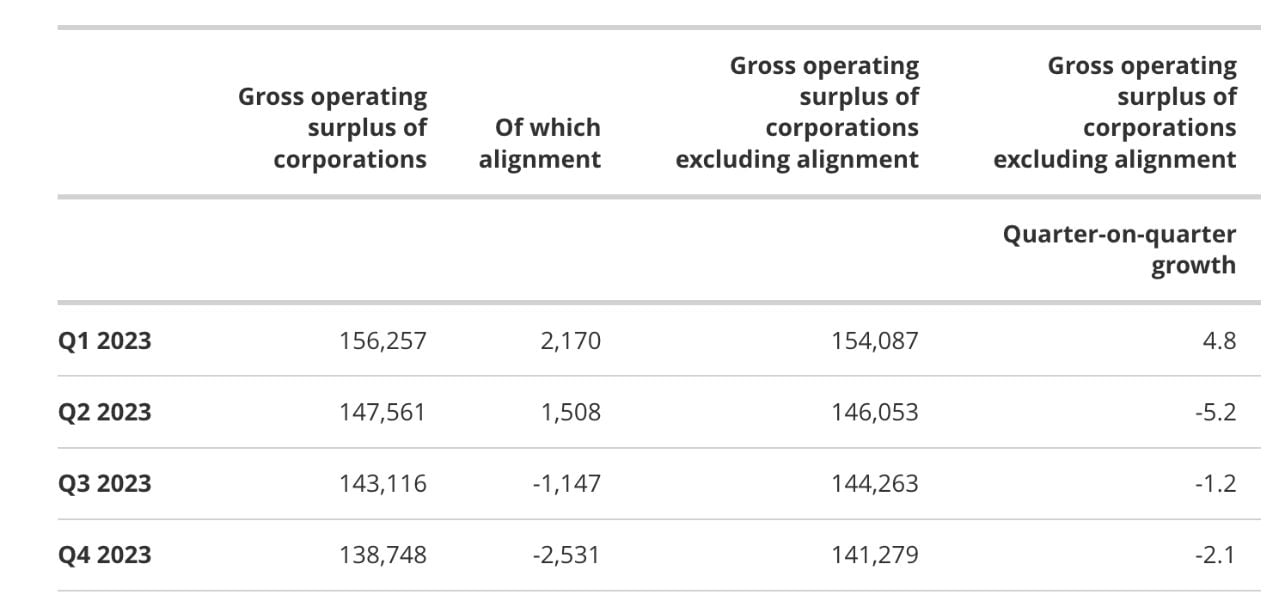

Figures showed that during the final three months of last year, there was a slowdown in all the main sectors it measures to determine the health of the economy, including construction and manufacturing.

“Our initial estimate shows the UK economy contracted in the fourth quarter of 2023. While it has now shrunk for two consecutive quarters, across 2023 as a whole the economy has been broadly flat.

“All the main sectors fell on the quarter, with manufacturing, construction and wholesale being the biggest drags on growth, partially offset by increases in hotels and rentals of vehicles and machinery.”

‘Shallow Recession’

Economists had widely expected a shallow recession at the end of last year as UK households came under pressure from higher borrowing costs and rising prices for everyday essentials, forcing cutbacks elsewhere.

But the figure for the final three months of last year was worse than a 0.1% fall widely forecast by financial markets and economists.

To make matters worse, recent figures showed that inflation remained at 4% in January, which is twice the Bank of England's 2% target. The Bank had been lifting interest rates to put the brakes on inflation but has kept them at 5.25% since August last year.

Still, economist Samuel Tombs from Pantheon Macroeconomics said it was "overly dramatic" to say that a fall in GDP for the second half of 2023 was a recession given that employment continued to rise and wages rose.

But Lord Rose, chairman of Asda, the supermarket group, said in an interview on BBC Radio 4's Today programme: "It looks like a duck, it quacks like a duck, it walks like a duck, it is a duck - it is a recession.

"It doesn't matter if it is a technical recession or not. There is no surprise here and I take no pleasure in saying there is no surprise that we're in it. We've got a low-growth economy or a no-growth economy."

More recent snapshots from the economy, however, have suggested a rebound in consumer confidence since the start of this year, supported by the prospect of interest rate cuts from the Bank of England as inflationary pressures cool.

UK chancellor Jeremy Hunt, said: “High inflation is the single biggest barrier to growth, which is why halving it has been our top priority. While interest rates are high – so the Bank of England can bring inflation down – low growth is not a surprise.

AI and the Modern Workforce

How AI, automation and self-service across the employee lifecycle are becoming core levers for retention, productivity and agility in recovery.

“But there are signs the British economy is turning a corner. Forecasters agree that growth will strengthen over the next few years, wages are rising faster than prices, mortgage rates are down and unemployment remains low. Although times are still tough for many families, we must stick to the plan – cutting taxes on work and business to build a stronger economy.”

The Impact of a Recession on London's Tech Sector

The news of the recession comes as the UK government positions London as a hub for technological innovation despite global economic pressures.

Just last month, Hunt championed British excellence in tech and called for further investment into the UK tech industry at the World Economic Forum Annual Meeting in Davos, Switzerland.

He outlined his optimism for the UK's economic growth and productivity despite the global uncertainties, saying that the tech industry will "drive growth across the UK economy in years to come" and supports the UK's ambition to be a science and technology superpower.

But if this recession leads to tighter budgets, individuals and businesses might spend less on tech products and services, impacting companies reliant on direct sales or advertising, as was seen towards the end of 2023.

Access to venture capital and other investments could become more challenging, especially for early-stage startups that rely heavily on external funding.

At the same time, areas like cybersecurity or automation might see increased demand due to recessionary pressures, as businesses seek efficiency and cost-saving solutions to keep themselves secure as the rate of cybercrime increases.

London's tech sector saw a downturn in the early months of 2023 but has shown signs of recovery since then, with job openings surging in June.

While investment in UK tech companies remains strong, there are concerns about future economic slowdown impacting funding availability.

Sachin Agrawal, UK Managing Director at Zoho UK, said: "Investment in UK technology is vital to support innovative businesses who are the backbone of the economy.”

Inside Cloud-First Overhauls

How leading consultancies use cloud, AI, data and IoT to modernize legacy estates and rewire enterprise operating models.

"Economic turbulence makes it even more critical for businesses to invest in technology and continue to innovate to fuel growth. This will drive flexibility and agility in businesses to increase their resilience to cope with external pressures beyond their control.

“Channelling further investment into UK technology will only serve to increase business opportunity and continue to contribute to the UK's economic growth."

Khalid Talukder, Co-Founder of DKK Partners also called for continued investment into London’s tech space despite economic downturns.

He commented: “The tech and FinTech sectors are driving forces for economic growth, fuelled by overseas investment and international trade from forward-thinking businesses.

“Further investment in areas such as payments can support these businesses to continue technology innovation as they connect the UK to emerging markets and open up new avenues for the UK to do business."

Comments ( 0 )