Customer experience is now a real-time, omnichannel exercise — and unified communications (UC) has become its foundation. In 2025, enterprises are under pressure to meet customers wherever they are: on a call, a video chat, or a message thread. Delivering that seamless experience depends on how well communication systems connect behind the scenes.

Hybrid work and AI have blurred the lines between internal collaboration and external service, making every interaction part of a wider CX ecosystem. When communication breaks down, opportunities are lost. When it flows, engagement deepens. For most organisations today, communication agility and integration aren’t IT concerns; they’re business imperatives.

AI copilots have accelerated this shift. Employees toggling between office and remote environments now rely on cloud collaboration suites to stay aligned, while customers expect every representative to have full context at hand.

AI-driven tools in platforms like Microsoft Teams, Zoom, and Webex are already summarising meetings, surfacing insights, and automating responses — freeing people to focus on empathy and resolution.

This convergence of hybrid work, AI integration, and omnichannel engagement has redrawn the boundaries of enterprise communications.

Why Unified Communications Is the New CX Engine

Modern unified communications extend far beyond phone calls or meetings. They create a single environment for telephony, video, messaging, and contact centre operations, increasingly delivered as cloud services. This integration aligns teams across departments so that customer enquiries can move smoothly from chat to call to screen-share — without losing context or time.

In practice, UC has become the operational layer that connects front-office responsiveness with back-office expertise, ensuring that every customer touchpoint benefits from shared knowledge and real-time visibility.

The data backs it up. According to Metrigy Research, 43.8% of companies have already unified their contact centre and UC platforms, with another 28.5% planning to do so by the end of 2024. Those integrations translate directly into faster response times and higher satisfaction.

When every channel sits on the same collaboration fabric, customers spend less time waiting and more time getting answers. Many platforms now feed these communications into CRM and analytics systems, where AI can detect sentiment or flag at-risk interactions for early intervention.

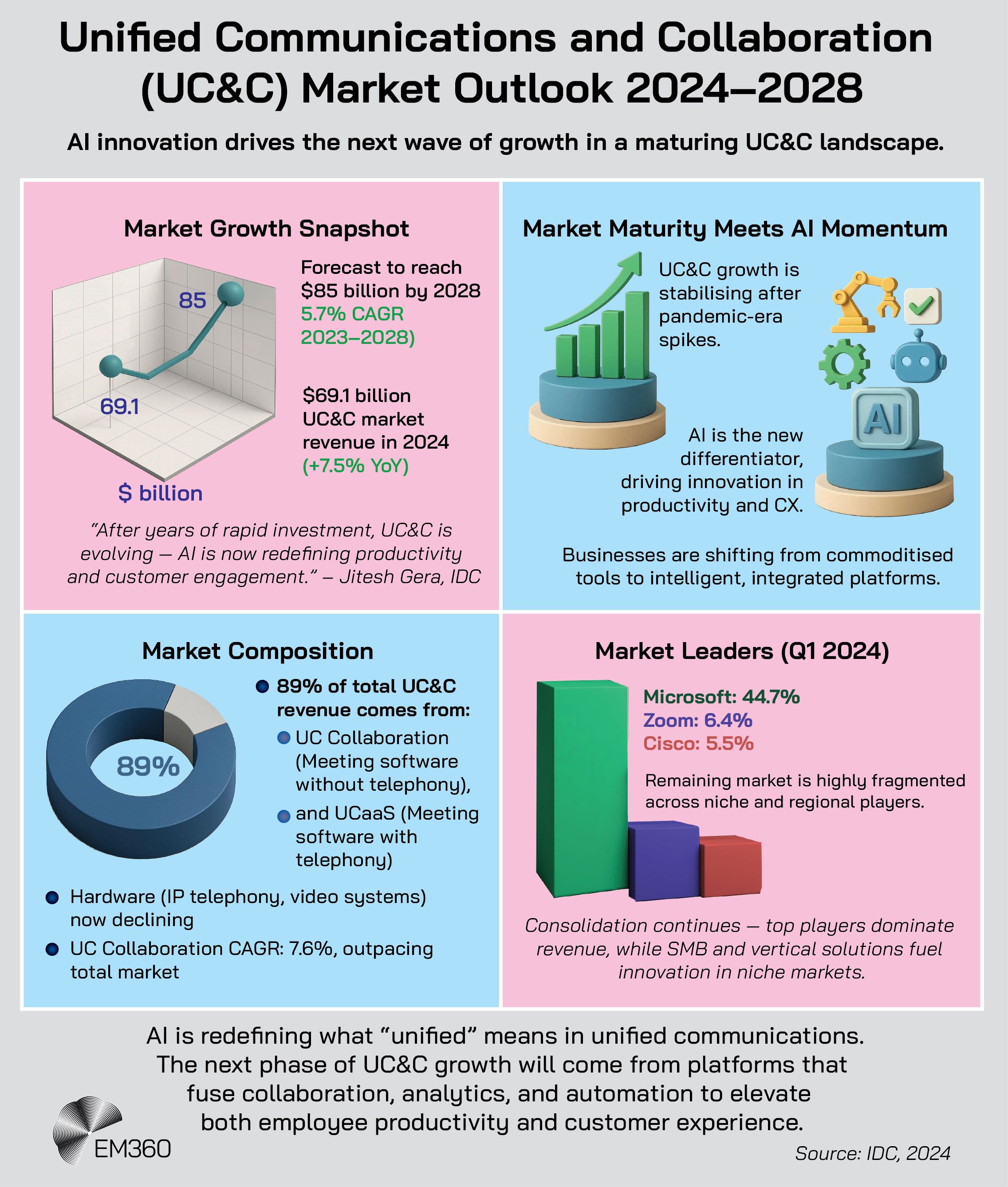

IDC projects that the global unified communications and collaboration (UC&C) market will reach $70 billion by 2025 as organisations invest in the infrastructure that connects people and data seamlessly.

The next evolution lies in intelligence and automation. AI copilots already handle routine tasks — transcribing meetings, recommending articles during support calls, and draughting follow-ups — allowing employees to focus on value-added interactions. Automated workflows can now route VIP customers to dedicated teams or update records the moment a call ends.

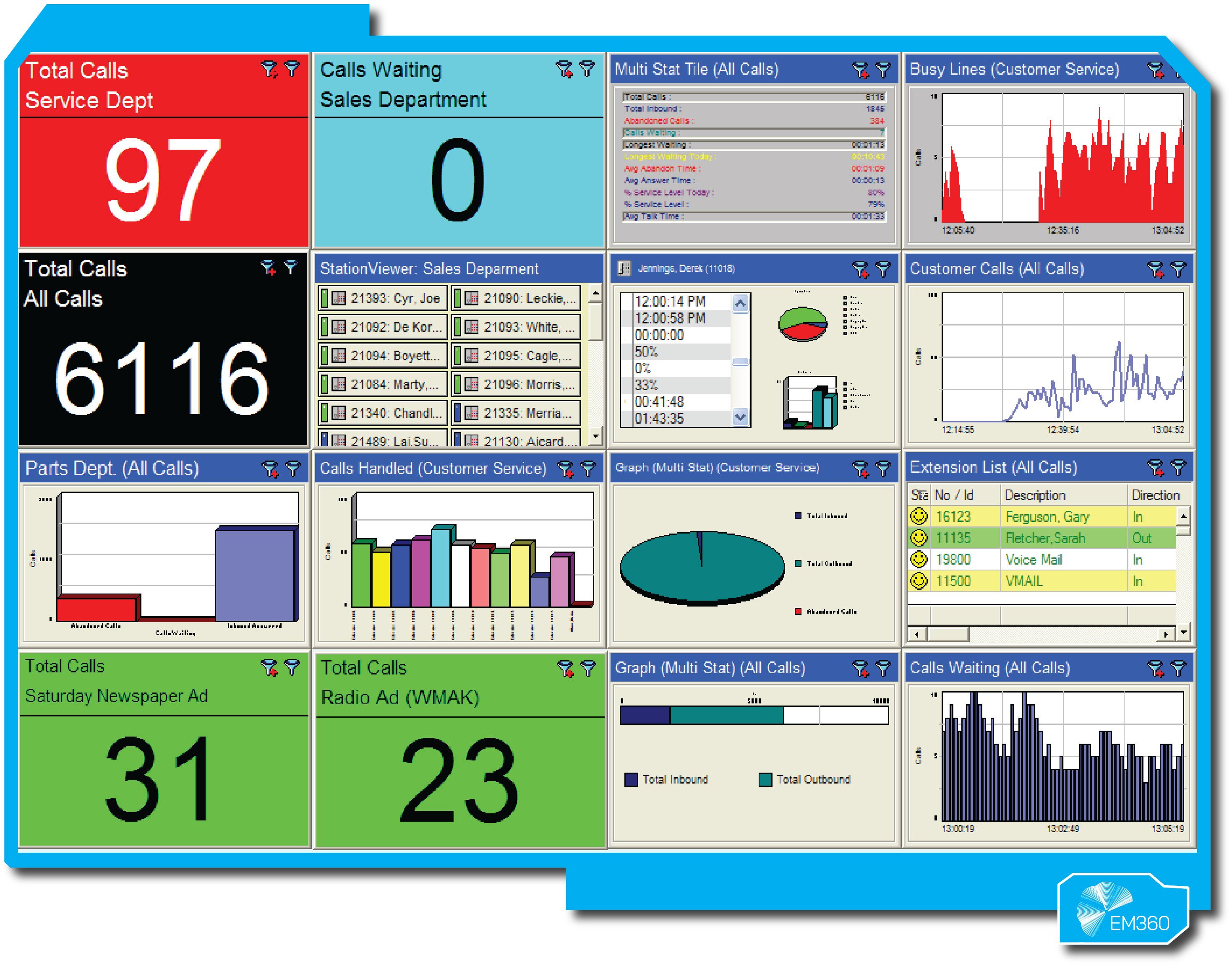

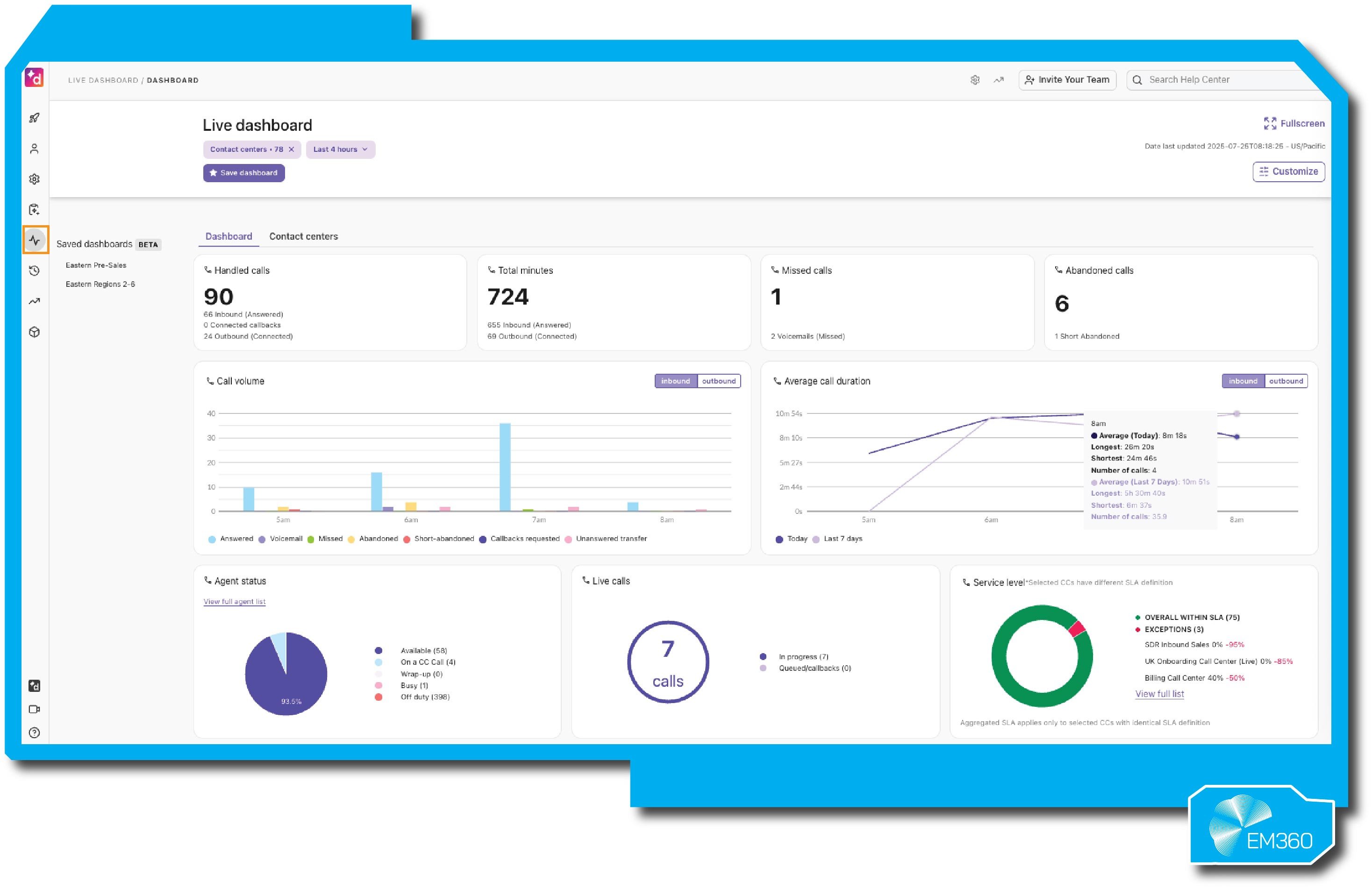

Meanwhile, communications analytics give leaders visibility into call volumes, resolution times, and sentiment trends, turning operational data into actionable improvements. The outcome is a more connected enterprise where collaboration drives experience and insight fuels service.

In short, unified communications has become a strategic lever for CX, transforming every conversation into an opportunity to strengthen loyalty and trust.

Key Trends Shaping UC and CX in 2025

AI copilots move into the workflow: AI is now built into the tools people already use. Microsoft Teams’ AI Facilitator produces meeting summaries and follow-ups; Zoom AI Companion handles live transcription, suggestions, and sentiment; and Cisco Webex layers real-time translation, noise reduction, and gesture recognition. These assistants reduce cognitive load, capture next steps, and help ensure no customer request slips through the cracks.

UCaaS and CCaaS are converging: Enterprises want one platform for internal collaboration and customer engagement. Nearly half of companies now use the same provider for UC and contact centre functions. Microsoft, Zoom, Cisco, RingCentral and 8x8 have responded with combined offers and tighter integrations, giving agents a single experience to consult colleagues and escalate from voice to video without leaving the console.

Hybrid and multi-cloud stay strategic: Not every organisation will go all-in on cloud immediately. Vendors with on-premise heritage, including Mitel and Avaya, enable a mix of on-site calling with cloud collaboration or contact centre modules. The model supports compliance, data residency and local survivability, and it lets teams modernise at a controlled pace.

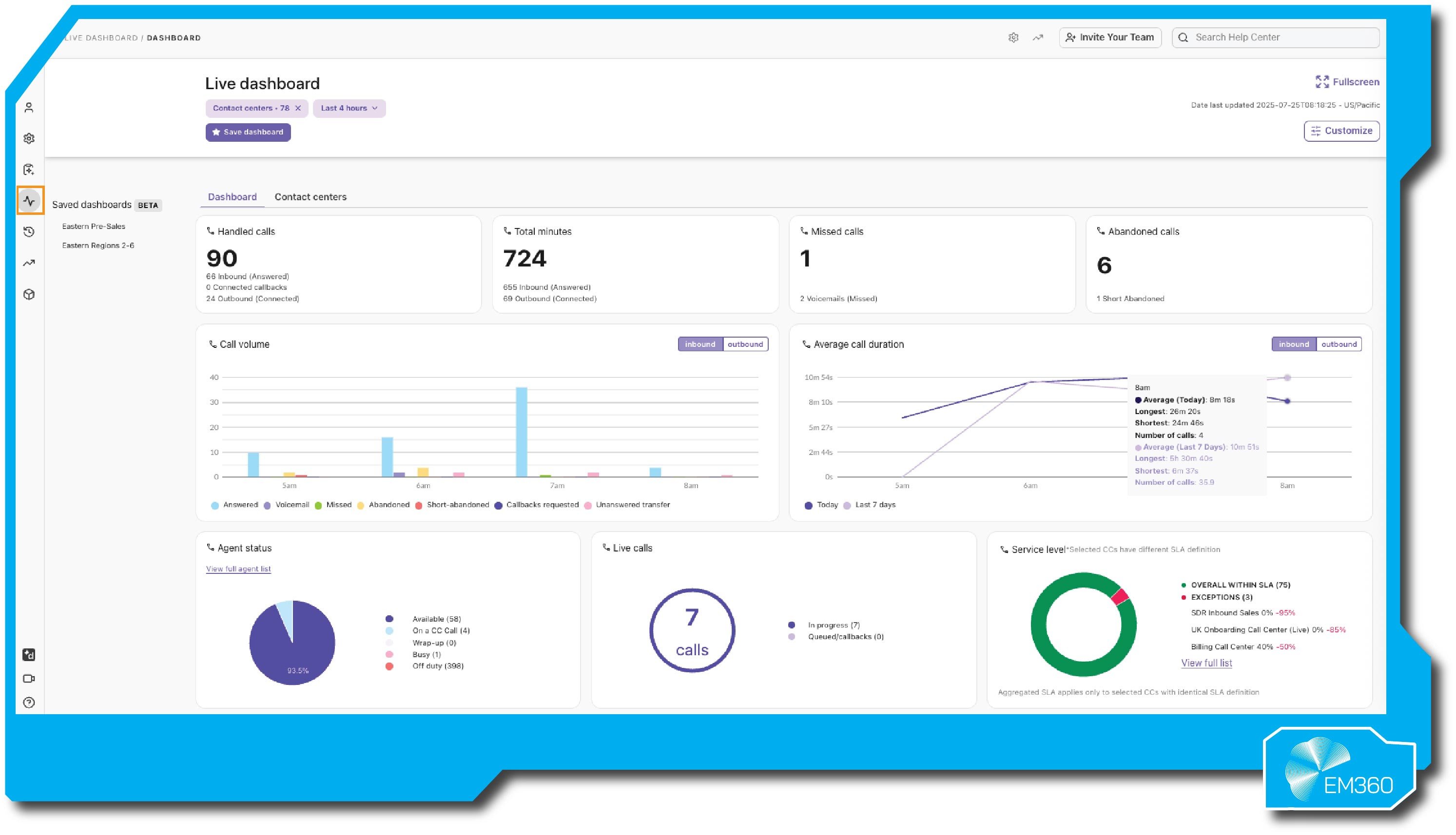

Data-driven CX becomes standard: UC platforms increasingly turn conversations into insight. Advanced analytics track sentiment, repeat contacts and escalation triggers, then feed CRM connectivity and coaching. Dialpad pioneered real-time sentiment and live guidance; Cisco Webex's latest contact centre tools add AI-based quality management to target coaching and improve outcomes.

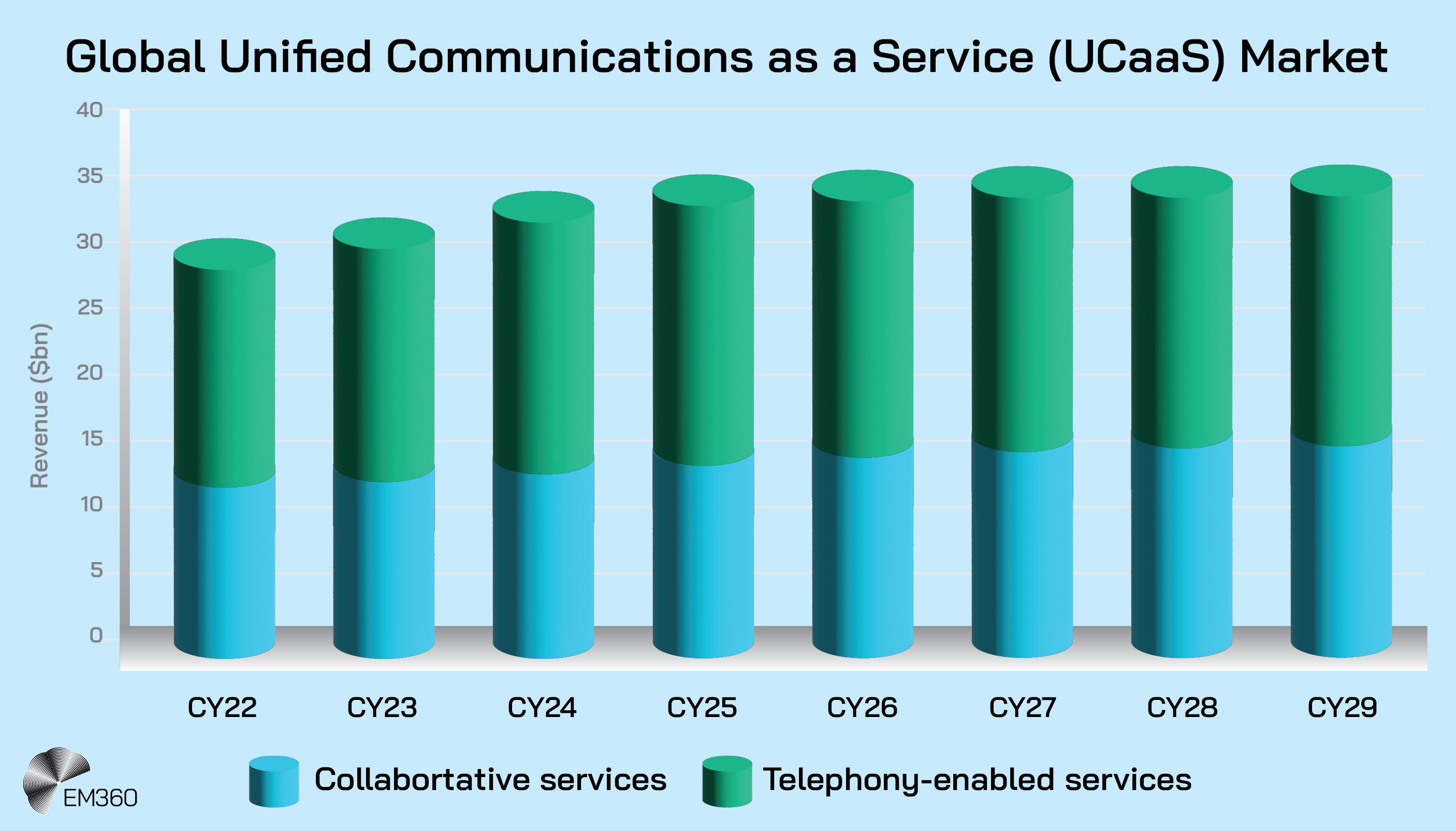

Growth moderates, sophistication rises: Omdia valued the UCaaS market at $33.4 billion in 2024, with growth slowing to 1.1% CAGR through 2029 as pricing pressure and bundling reshape competition. Consolidation continues: legacy telephony aligns with cloud specialists (Mitel with RingCentral and now Zoom; Avaya via cloud partnerships), while leaders such as Microsoft, Cisco, Zoom, and RingCentral expand portfolios to one-stop suites.

Adoption still climbs: Gartner forecasts that by 2028, companies will rely on cloud office platforms for enterprise telephony, up from 30% in 2025.

The direction is clear: less fragmentation, more AI, and tighter UC plus customer engagement stacks that elevate service quality at scale.

The Top 10 UC Platforms Driving Customer Experience in 2025

In light of the above trends, which unified communications platforms are leading the way in powering enterprise customer experience? Below we profile the top platforms (in alphabetical order) defining CX-focused communications this year. Each is evaluated on its enterprise-ready features, pros, cons, and ideal use cases:

8x8

Founded in 1987, 8x8 evolved from VoIP to a global UC leader with XCaaS that unifies UCaaS and contact centres in one platform. It emphasises reliability, security and global reach and is regularly recognised by analysts for its end-to-end approach that serves both employee collaboration and customer engagement.

Enterprise-Ready Features

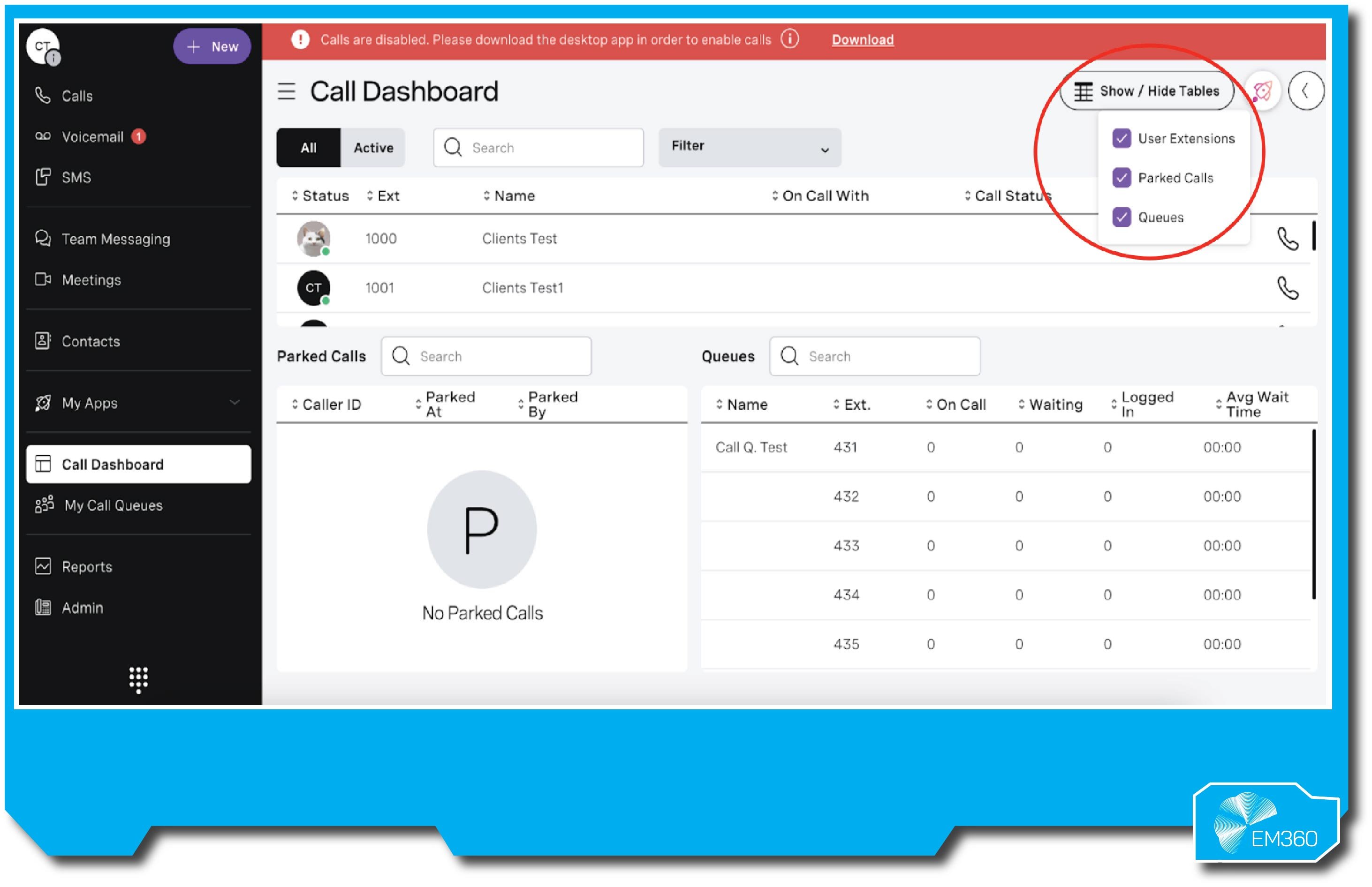

8x8 delivers cloud telephony with PSTN, HD video, team chat and a full contact centre in a single interface, so agents can call, meet and message without switching tools. It integrates with major CRMs to sync context into every interaction and provides real-time dashboards and quality management across voice and digital channels.

AI features include virtual assistants, speech analytics, transcripts and post-call summaries, while workflow automation simplifies routing and auto-attendants. The platform scales from small sites to tens of thousands of users, offers enterprise-grade security and compliance, and backs service with financially guaranteed uptime SLAs.

Pros

- Unified UC, contact centre and CPaaS for end-to-end communications.

- Broad international telephony footprint with local numbers in many countries.

- Strong analytics and quality monitoring out of the box.

- Deep integrations with CRM and productivity suites.

- High reliability with robust security certifications.

Cons

- Collaboration UX is less polished than specialist chat-first tools.

- Admin can feel complex due to the breadth of capabilities.

- Packaging can be less flexible for very small or single-workload needs.

Best For

Enterprises and mid-market teams consolidating vendors into one global platform for voice, video, messaging and customer service, especially organisations with distributed operations or regulated requirements that value integrated analytics and dependable uptime.

Avaya Experience Platform

Avaya brings decades of enterprise telephony and contact centre expertise to a cloud-first Experience Platform that blends UCaaS and CCaaS. It supports true omnichannel engagement and prioritises security, compliance, and customisation for large, complex environments with hybrid options that protect on-prem investments while moving to the cloud.

Enterprise-Ready Features

The suite covers enterprise calling, meetings, team workspaces, and integrations with productivity tools, as well as a unified agent desktop for voice, chat, messaging apps, and social channels. Customers retain context as they move channels, improving satisfaction and resolution speed.

AI adds virtual agents, real-time transcription, sentiment analysis and supervisor insights, while an API-first design enables deep CRM and line-of-business integrations. The multitenant cloud can scale from small teams to massive deployments, while its controls for encryption, recording, and regulatory adherence ensure compliance with stringent requirements.

Pros

- Full omnichannel engagement across voice, video, chat, SMS and social.

- AI and analytics that elevate agent assistance and quality management.

- Open APIs for bespoke workflows and industry-specific integrations.

- Strong security and compliance aligned to enterprise standards.

- Hybrid deployment to extend existing Avaya estates into the cloud.

Cons

- Learning curve for teams moving from legacy Avaya to the new cloud UX.

- Ecosystem momentum is rebuilding and can trail larger UCaaS rivals.

- Collaboration depth is lighter than born-in-cloud teamwork platforms.

Best For

Large enterprises and public sector organisations needing combined UC and contact centres with rigorous compliance, omnichannel journeys and custom integration paths, including those migrating from established Avaya on-prem systems at a controlled pace.

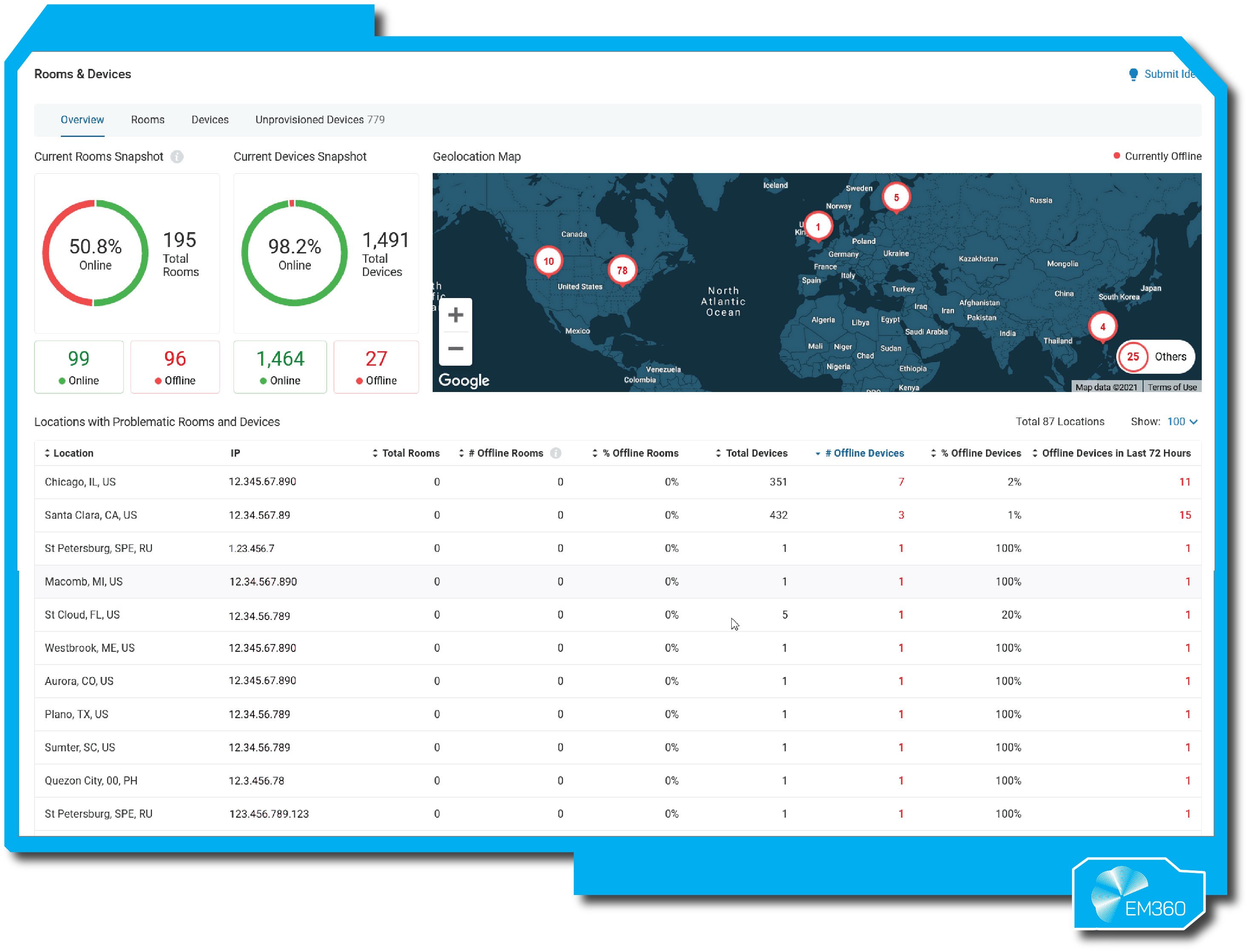

Cisco Webex Suite

Cisco Webex is an enterprise-grade collaboration suite covering calling, meetings, messaging and contact centre, reinforced by Cisco’s devices and global network. It is known for reliability, security, and AI-enhanced experiences, and it is a frequent choice for large or regulated organisations that want end-to-end control.

Enterprise-Ready Features

Webex supports HD meetings, persistent messaging and cloud PBX with PSTN via Cisco cloud or hybrid integration with Cisco Call Manager. Webex Calling scales from small sites to more than 100k users, and tight device integration delivers premium room and desk experiences.

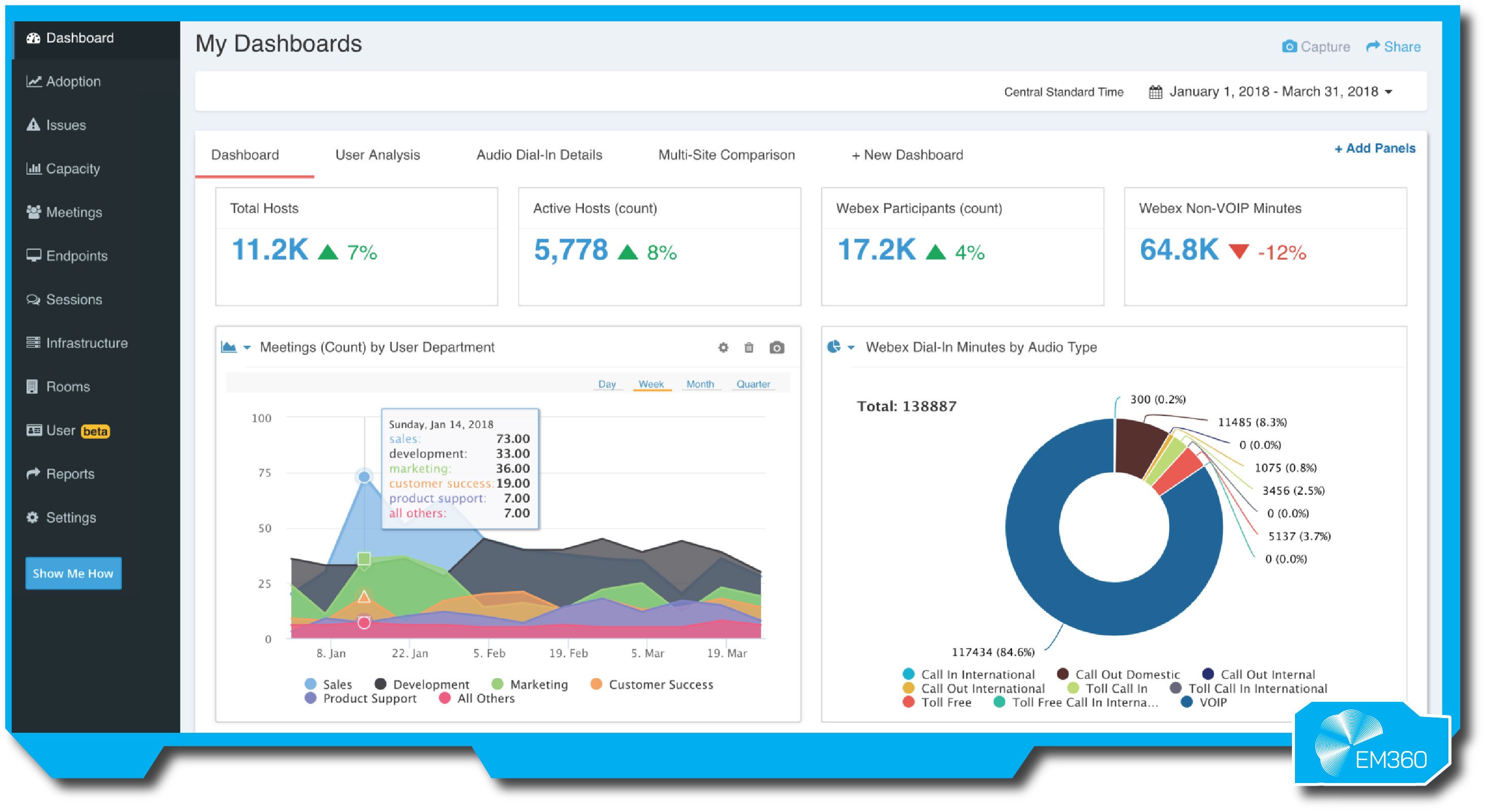

Webex Contact Center adds omnichannel engagement with AI for assistance, chatbots, noise removal, real-time translation, transcripts, summaries and gesture recognition. Security includes end-to-end encryption options, customer-managed keys, DLP, and extensive certifications, while interoperability spans Microsoft 365, Google Workspace, Salesforce, and cross-platform meeting joins.

Pros

- Comprehensive suite spanning UC, contact centre and certified devices.

- Mature AI features that improve meeting quality and agent productivity.

- Market-leading security and compliance for regulated sectors.

- Flexible cloud and hybrid deployment for gradual migrations.

- Deep hardware ecosystem for consistent room and desktop experiences.

Cons

- Administration can be complex for smaller IT teams.

- Total cost can be higher, especially with proprietary hardware.

- A Cisco-centric stack may not suit organisations seeking a completely open mix.

Best For

Multinationals and regulated industries that prioritise reliability, scale and compliance and that benefit from integrated devices plus advanced AI features across meetings, calling and customer engagement.

Dialpad

Dialpad is an AI-first cloud communications platform for calling, meetings, messaging and contact centres, built on real-time transcription and NLP from its TalkIQ heritage. It focuses on simplicity, rapid deployment and continuous product iteration for teams that value intelligent assistance.

Enterprise-Ready Features

A single app provides global telephony, video conferencing, SMS/MMS, and productivity integrations, with DialpadAI delivering live transcripts, action items, and configurable playbooks that guide agents and sellers in the moment. Post-call summaries and sentiment scores support coaching and quality.

Contact centre capabilities include IVR, skills-based routing and analytics dashboards, while integrations with Google Workspace, Microsoft 365, Salesforce and HubSpot keep records in sync. Admin is web-based and straightforward, scaling from small teams to mid-size enterprises, with workforce management available via add-ons.

Pros

- Native AI is for live guidance, transcription, and post-call insight.

- Clean, modern UX that deploys quickly with minimal training.

- Unified app for UC and contact centre to reduce tool sprawl.

- Competitive international numbering and cost-efficient pricing models.

- Strong productivity gains reported by tech-savvy teams.

Cons

- Video and chat depth trails leaders focused primarily on those workloads.

- Brand scale can give conservative enterprises pause for very large rollouts.

- Complex contact centre or bespoke reporting needs may exceed native depth.

Best For

Agile small and mid-sized organisations and customer-facing teams that want easy cloud communications with meaningful AI assistance, especially Google Workspace users and fast-growing firms prioritising speed, usability and actionable conversation data.

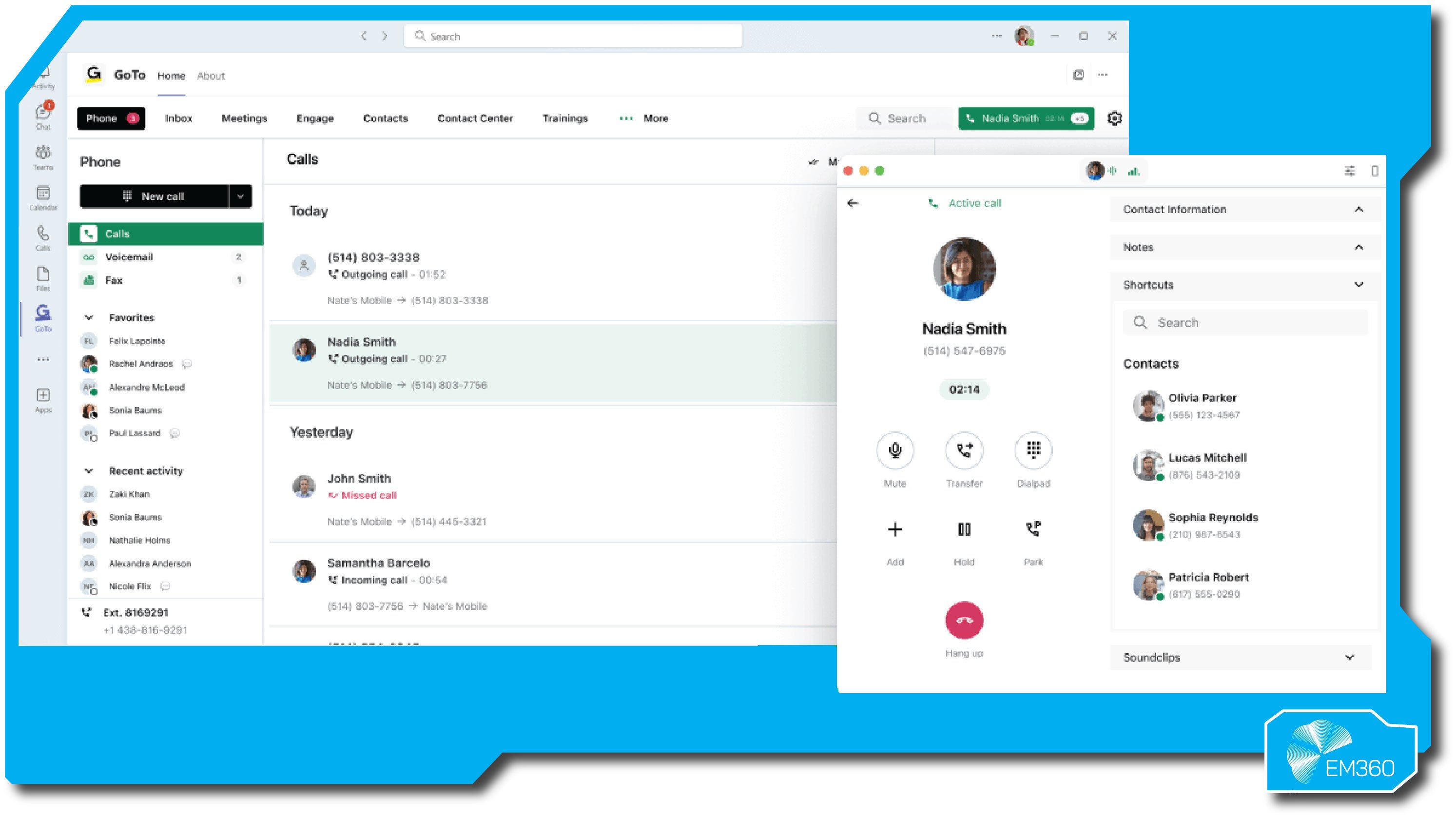

GoTo Connect

GoTo Connect is an all-in-one cloud phone, meetings and messaging platform built for small and mid-market teams that want simplicity, reliability and value. It sits alongside GoTo Meeting and GoTo Webinar and is known for its quick setup, intuitive admin, and solid uptime for organisations without large IT teams.

Enterprise-Ready Features

Core cloud PBX functions include call routing, IVR, ring groups, call recording, and voicemail to email, as well as integrated video meetings, team chat, SMS, and optional faxing. The drag-and-drop dial plan editor lets admins design call flows that mirror business logic and improve caller experience.

Recent additions bring noise suppression and meeting transcription. Integrations cover Microsoft Outlook and Teams; Google Workspace; Salesforce; and Zendesk, with a lightweight contact centre add-on for queues and analytics. Reporting tracks usage and quality, mobile apps support calling with a business identity, and security aligns to industry standards, including GDPR.

Pros

- Fast deployment and straightforward admin with a visual call flow editor.

- Cost-effective pricing that brings enterprise-grade calling to smaller teams.

- Reliable core voice quality and responsive support.

- Meetings and messaging in one app reduce tool sprawl.

- Practical feature updates that improve daily use without added complexity.

Cons

- There is limited access to advanced AI and deep contact centre features.

- Smaller third-party ecosystem and fewer high-end integrations.

- Best suited to SMB and mid-market rather than very large, highly customised estates.

Best For

SMB and midmarket organisations, or branch offices, that need a dependable cloud phone system with integrated meetings and chat, quick setup, and manageable administration without heavy customisation.

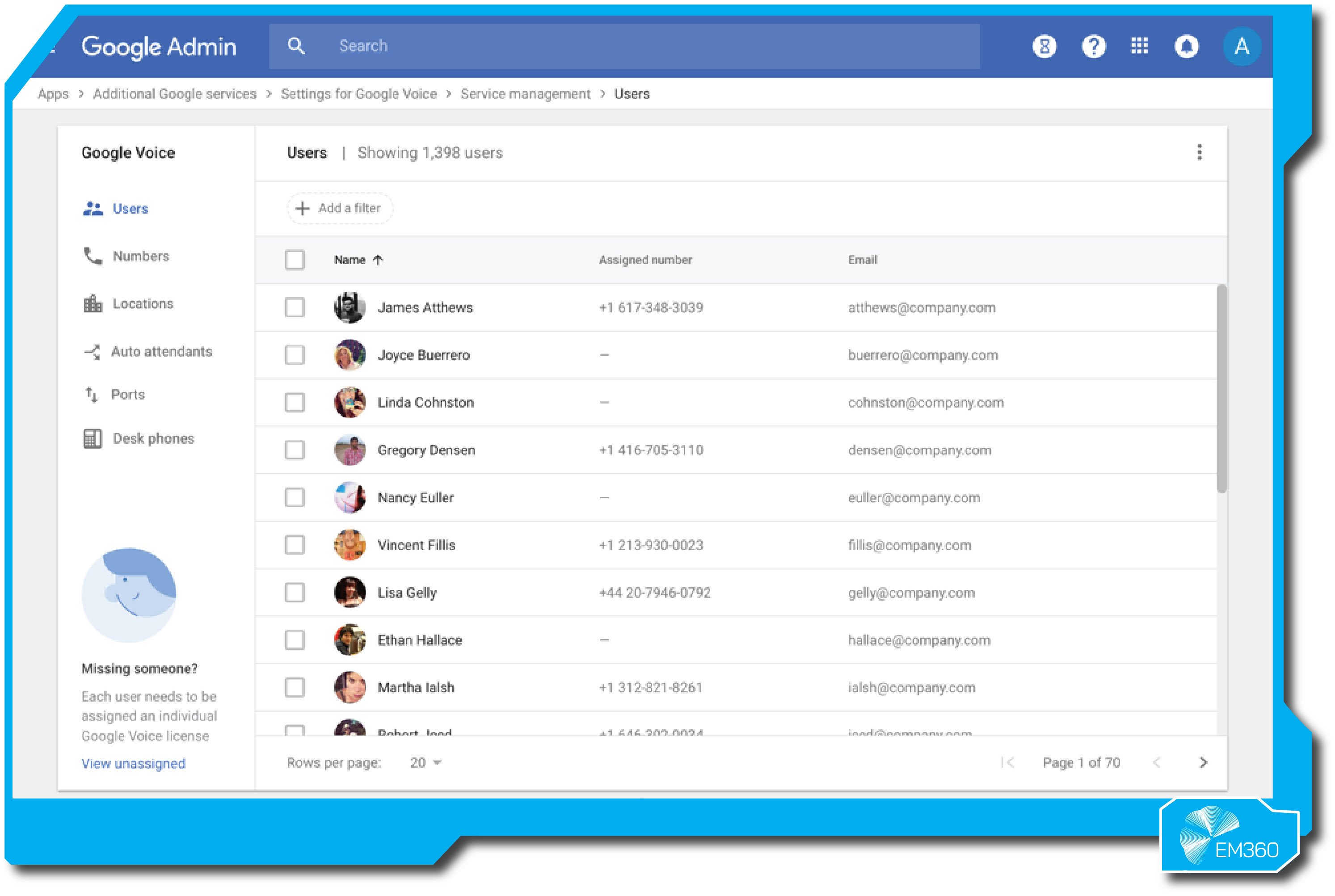

Google Workspace (with Google Voice)

Google Workspace pairs Gmail, Calendar, Meet and Chat with Google Voice to form a practical UC stack inside the Google ecosystem. It prioritises ease of use, AI-assisted experiences, and tight workflow integration, making it a natural fit for Google-centric teams that want communications alongside their everyday productivity tools.

Enterprise-Ready Features

Google Meet supports large video meetings with screen sharing, recording to Drive, polls and Q&A, plus live captions and noise cancellation. Google Chat provides Spaces for team messaging, embedded within Gmail for low-friction adoption.

Google Voice adds business numbers, auto attendants, ring groups and voicemail transcriptions. Availability and advanced routing are more basic than specialist UCaaS, and Google relies on partner CCaaS for its full contact centre needs. Administration is centralised; security includes encryption and vault retention; and interoperability extends to SIP room systems via partners.

Pros

- Seamless email, chat, video and voice inside the Workspace experience.

- Best-in-class live translation and captioning in Meet for global teams.

- Familiar UX reduces training and speeds adoption.

- Useful AI conveniences like transcripts and smart scheduling.

- Strong cloud reliability and security at Google scale.

Cons

- Google Voice has limited advanced telephony and geographic coverage.

- No native contact centre; third-party integration is required.

- Collaboration depth and app ecosystem can trail Microsoft for some use cases.

Best For

Organisations already on Google Workspace that want straightforward telephony and rich video collaboration without adding a separate UC stack, especially distributed teams that value multilingual meetings and simple administration.

Microsoft Teams

Microsoft Teams is the collaboration hub in Microsoft 365, combining chat, meetings and calling with deep Office integration. Adoption is broad, with more than 320 million users and over 20 million on Teams Phone, and it anchors internal collaboration while extending to customer engagement through a strong partner ecosystem.

Enterprise-Ready Features

Teams delivers persistent channels, large-scale meetings and webinars, recording, transcripts and co-authoring with SharePoint files in context. Teams Phone provides PSTN via Calling Plans, Operator Connect or Direct Routing, with queues, auto attendants, voicemail and certified devices.

The platform is highly extensible through an app store and Power Platform and supports external collaboration via guest access and shared channels. Microsoft Copilot adds AI summaries and task suggestions. Admin, compliance and analytics run through the Microsoft 365 stack with global SLAs and geo-redundancy.

Pros

- Deep integration with Microsoft 365 for seamless workflows.

- One app for chat, meetings and calling reduces fragmentation.

- Large app ecosystem and low-code extensibility with Power Platform.

- Enterprise-grade security, compliance and identity via Entra ID.

- Rapid innovation with AI features such as Copilot and intelligent recap.

Cons

- Native telephony and contact centre depth can require partners.

- Resource demands and occasional performance issues need tuning.

- Value is strongest for organisations already standardised on Microsoft 365.

Best For

Mid-to-large enterprises standardised on Microsoft 365 that want a secure, extensible hub for collaboration and telephony with partner options for complex contact centres and global PSTN needs.

Mitel

Mitel is a long-standing voice specialist with a strong PBX heritage and a flexible path to the cloud. It supports on-prem, cloud and hybrid deployments and partners with providers like RingCentral and Zoom so customers can modernise collaboration while preserving proven Mitel telephony and devices.

Enterprise-Ready Features

On-prem MiVoice platforms deliver advanced PBX, ACD and multi-site networking with five-nines reliability, while MiCollab adds softphone, messaging and conferencing. Hybrid models use CloudLink to connect on-site voice to cloud collaboration and contact centres; partnerships broaden options for meetings and UCaaS.

Contact centre products include voice, email, and chat routing with supervisory tools. Endpoint breadth spans IP, DECT and paging for vertical needs. Centralised management supports large estates, and survivability, compliance recording and analogue integration address mission-critical environments.

Pros

- Flexible on-prem, cloud and hybrid paths that protect investments.

- Deep telephony features for complex routing and multi-site estates.

- Proven scale and reliability in large, mission-critical deployments.

- Partnerships unlock modern UCaaS without abandoning Mitel Voice.

- Strong fit for vertical requirements like healthcare and government.

Cons

- Native collaboration UX can feel dated versus born-in-cloud peers.

- Partnership model can add vendor complexity for billing and support.

- AI innovation is modest compared to cloud-first competitors.

Best For

Enterprises with significant on-prem voice, strict compliance or survivability needs that want a measured path to cloud collaboration, and organisations that value rock-solid telephony with hybrid flexibility over rapid feature churn.

Nextiva

Nextiva is a cloud communications provider that unifies calling, meetings, messaging and a light CRM/helpdesk into a Unified Customer Experience Management (CXM) platform. It focuses on simplicity, reliability and service, giving teams a 360-degree view of interactions and moving mid-market customers toward an integrated, data-led CX model.

Enterprise-Ready Features

NextivaONE is the hub for calling, SMS, video, team chat and customer context in one interface, with auto attendants, queues, voicemail to email and mobile and desktop apps. Built-in CX tools surface history, notes and tickets at the moment of contact, while AI adds sentiment analysis and intelligent virtual agents for routine tasks.

Dashboards blend communication metrics with customer data, tracking volumes, response times and satisfaction trends across channels. The platform integrates with Salesforce, HubSpot, and Zendesk; offers CCaaS for skills-based routing and outbound campaigns; delivers 99.999% uptime on its own network; and meets SOC 2 and related standards.

Pros

- Communications and customer data live in one workflow.

- An intuitive app reduces tool switching and speeds adoption.

- Highly rated support that smooths onboarding and change.

- UCaaS and CCaaS in one vendor simplify operations and cost.

- Practical AI for sentiment and automation improves CX at scale.

Cons

- CRM depth is lighter than specialist platforms in complex scenarios.

- International coverage lags some global-first competitors.

- Closed posture limits advanced custom development for very large estates.

Best For

Service-led SMB and mid-market organisations that want to consolidate phones, collaboration and customer context, and teams that prefer an integrated path to CCaaS without stitching multiple tools together.

RingCentral

RingCentral is a pioneer of cloud UC with a mature, scalable platform and global reach. RingCentral MVP combines messaging, video, and phone capabilities with integrated contact centre options and a broad API and app ecosystem that supports custom workflows and complex migrations from legacy PBX environments.

Enterprise-Ready Features

MVP delivers enterprise telephony with multi-level IVR, queues, recording and SMS/MMS in the same app, plus HD video meetings and team messaging with files and tasks. Contact centre options include omnichannel routing, workforce optimisation, and analytics, while global office features provide local numbers and emergency services in dozens of countries.

Extensive integrations cover Microsoft 365, Google Workspace, Salesforce, Zendesk and Slack, with performance analytics and QoS monitoring for voice quality. AI services add meeting summaries, transcripts and intent insights, and security and compliance include encryption, HIPAA, and GDPR with multi-region redundancy.

Pros

- Feature-rich UCaaS that covers complex enterprise needs.

- Strong voice capabilities ease PBX replacement and migration.

- Large integration and API ecosystem for tailored workflows.

- Continuous AI improvements drive productivity and insight.

- Proven global scale with centralised management.

Cons

- Breadth adds complexity and a learning curve for admins and users.

- Pricing can rise with contact centre seats and advanced add-ons.

- Voice quality relies on network stability and may need SD-WAN investment.

Best For

Mid-size to large enterprises standardising on a comprehensive UCaaS with global telephony, deep integrations and optional contact centre, especially where legacy PBX migration and cross-application workflows are priorities.

Vonage Business Communications

Vonage has evolved into an enterprise communications provider, spanning UCaaS, CCaaS, and CPaaS under the Vonage Communications Platform. VBC delivers cloud voice, video and messaging, while Vonage Contact Center and its APIs enable tight CRM workflows and embedded communications for flexible, data-driven customer engagement.

Enterprise-Ready Features

VBC includes unlimited calling, a virtual receptionist, queues, recording, and a unified mobile and desktop app for calls, SMS, and collaboration, as well as video meetings for smaller groups. Integrations with Microsoft Teams, Google Workspace, Salesforce, HubSpot and Zoho streamline calling in the tools users already live in, including PSTN enablement behind Teams.

Vonage Contact Center embeds inside CRMs for screen pops, automated logging and omnichannel routing, and APIs extend to SMS, WhatsApp, and programmable voice for bespoke experiences. AI adds virtual assistants and conversation analytics, with global numbering coverage, AWS-backed reliability and certifications such as GDPR, HIPAA, and ISO27001.

Pros

- One provider for UC, contact centre and programmable APIs.

- Excellent CRM integrations, especially within Salesforce.

- CPaaS enables custom channels and automated journeys.

- Global reach strengthened by carrier relationships and Ericsson.

- Steady AI innovation in routing, assistance and analytics.

Cons

- Product breadth can feel complex for simple telephony needs.

- Very large enterprises should validate scale and support models.

- Admin UX is powerful but can require guidance to master.

Best For

Mid-market and innovation-focused teams that want flexible UC with strong CRM alignment and the option to embed communications via APIs, as well as organisations prioritising omnichannel engagement without multiple vendors.

Zoom Workplace

Zoom has expanded from meetings to a full Zoom Workplace stack that includes Team Chat, Zoom Phone, Rooms and an integrated contact centre. It focuses on usability, quality and rapid feature delivery, with AI Companion enhancing productivity and consistent experiences that drive high user adoption.

Enterprise-Ready Features

Zoom Meetings offers HD video and audio, breakout rooms, polls, recording, and real-time transcription and translation, along with a smart gallery and gesture recognition for better hybrid participation. Zoom Phone adds cloud PBX with global calling options, IVR, voicemail transcription and SMS in the same app, with smooth handoff between devices.

Zoom Contact Center supports voice and video service with skills-based routing and CRM integrations, complemented by self-service from the Solvvy acquisition and conversation intelligence for sales. Security now includes end-to-end encryption, advanced waiting rooms, watermarking, and industry certifications, while a broad hardware and app marketplace extends the capabilities of rooms and workflows.

Pros

- Highly intuitive UX that accelerates adoption across the business.

- Consistently strong audio and video quality at scale.

- Fast innovation cadence with practical AI features.

- Native contact centre designed for video-rich engagement.

- Trusted options for regulated sectors and secure deployments.

Cons

- Expanding from meetings to full UC requires careful change management.

- Growing suite increases admin complexity and governance needs.

- New productivity apps are early-stage for many enterprises.

Best For

Organisations that prioritise ease of use and video-led collaboration, from SMB to enterprise, and teams that want unified meetings, chat and telephony with the option to add a video-centric contact centre for high-touch customer service.

How to Choose the Right UC Platform for Your Enterprise

Selecting a unified communications platform is a strategic decision that can impact your organization's productivity and customer satisfaction for years. Here are key factors and considerations that guide IT and business leaders in making the right choice:

Scalability and flexibility: Match the platform to your growth and deployment model. If you need global numbers and rapid expansion, prioritise cloud scale; if compliance or survivability dictates local control, shortlist hybrid options that keep core calling on-prem while layering cloud collaboration.

Integration with your stack: Choose a platform that plugs cleanly into CRM, productivity and industry systems. Out-of-the-box connectors or mature APIs reduce context switching and put call data, transcripts and tasks where people already work.

Total cost of ownership: Model three to five years, not month one. Include licences, devices, implementation, support, network upgrades and legacy PBX retirements. Balance “all-in” suites that cut vendor sprawl against à la carte add-ons that inflate costs later.

Security and compliance: Verify encryption options, data residency, audit trails and certifications relevant to your sector. Ensure SSO, MFA and granular admin policies are standard. Strong governance lowers risk and speeds enterprise rollout.

Reliability and support: Check SLA commitments, redundancy design and failover behaviour. Look for multi-region data centres, PSTN survivability and 24x7 support with clear escalation. Uptime and response quality directly influence CX.

Features that map to need: Buy for your use cases, not the brochure. If analytics and coaching matter, prioritise native sentiments and quality dashboards. Test the mobile client first if your employees are on the go or on the front lines. Avoid paying for features you will not deploy.

User experience and adoption: Pilots reveal more than datasheets. Compare UI clarity, call quality and admin simplicity, then plan training and change management. A platform that people like will deliver faster time to value.

Align these criteria with business goals and culture, involve IT, security and CX leaders, and you will land on a platform that improves collaboration and elevates customer experience.

What’s Next for Unified Communications and CX

Generative AI moves from assistant to co-creator: Tools such as Microsoft Copilot, Google, and Zoom AI will draft messages, provide surface context, and propose actions by default. Gartner expects that by 2026, 40% of business applications will include AI agents that can act on their own, allowing machines to handle regular communication while humans ensure the information is correct and appropriate.

Predictive, proactive service: UC data and journey signals will feed models that flag churn risk, trigger outreach and route customers to the agent most likely to resolve it the first time. Expect more interventions before issues become tickets.

Agentic automation across workflows: Autonomous agents will chain tasks across apps after meetings or calls, from scheduling and CRM updates to order creation. Gartner’s AI roadmaps point to networks of collaborating agents by 2028, pushing routine follow-ups out of the human queue.

Unified data, fewer silos: UCaaS, CCaaS, CRM, and productivity will converge into shared data layers. Enterprises will increasingly select ecosystem platforms that cover most needs, while guarding against lock-in with open APIs and data portability.

The future of work is multilingual and hybrid-native: Real-time translation, video-first service and room-to-remote parity will become table stakes. Asynchronous video with AI summaries will reduce meeting load and keep projects moving across time zones.

Enterprises that lean into AI, analytics, and integration—without compromising governance—will set the pace for customer experiences.

Final Thoughts: Communication Is the Heartbeat of Experience

Treat your UC strategy as a CX decision. The organisations that win on experience design for speed, context and continuity across every touchpoint. That demands a communications layer that is reliable, integrated and measurable.

Prioritise the levers that move outcomes. Align UC with contact centre for a single workflow. Invest in AI integration where it removes friction, then govern it. Make analytics a first-class capability so leaders can see sentiments, resolutions, and efforts in real time. Build resilience, data sovereignty and hybrid work from the start.

Operationalise for adoption. Give owners in IT, security and the business shared accountability. Train managers, not only users. Retire redundant tools, keep policies simple; and review metrics monthly. This is how enterprise collaboration turns into CX leadership.

If you want decision-grade guidance on what to do next, EM360Tech publishes analyst briefs, executive playbooks and peer lessons that help leaders turn technology choices into customer outcomes.

Comments ( 0 )