Have you ever dreamt of owning your very own digital dinosaur, virtual money, or simply a lump of pixels? With Non-Fungible Tokens (NFTs), you can turn those dreams into reality. Well – sort of.

The allure of owning a piece of the internet took the world by storm in the early 2020s, with tech enthusiasts, celebrities, and even normal people spending real money to buy into the idea.

But with concerns about market saturation and copyright issues looming, some question whether the NFT craze has reached its peak. Is it time to reality time to hit pause on these pixel investments and think about their future?

This article examines the journey of NFTs, charting their meteoric rise from niche blockchain assets to mainstream fame, their subsequent decline amid market oversaturation and speculation, and their promising future.

What are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital assets that signify ownership or authenticate a specific item or content piece. They're usually stored on a blockchain, the decentralised digital ledger technology powering major cryptocurrencies such as Bitcoin and Ethereum.

NFTs are different to cryptocurrencies like Bitcoin or Ethereum because they are indivisible and cannot be replicated. Each NFT possesses unique metadata that sets it apart from any other token, making it one-of-a-kind and irreplaceable.

This uniqueness is what adds value to NFTs as collectors and enthusiasts pursue ownership of digital art, music, videos – and even memes.

The surge in interest surrounding NFTs sparked a digital revolution in the early 2020s, offering creators unprecedented opportunities for monetisation and ownership in the metaverse.

With NFTs, artists, musicians, and content creators can tokenise their work, establishing verifiable authenticity and unlocking new revenue streams through direct sales and royalties.

This groundbreaking technology democratises access to digital assets and opens up avenues for innovation across industries, paving the way for a new era of digital ownership and creativity.

What Does NFT Stand For?

A NFT stands for Non-Fungible Token. It is a digital asset representing ownership of unique items, such as art, music, videos or collectables, secured by blockchain technology. Unlike cryptocurrencies like Bitcoin or Ethereum, NFTs are non-fungible, meaning each is unique and cannot be exchanged on a one-to-one basis.

These assets have gained significant popularity in recent years due to their use in the digital art world, gaming, and the metaverse. Many creators and investors see NFTs as a revolutionary way to authenticate and monetise online content.

If you are wondering, "What does NFT mean in simple terms?" think of it as a digital certificate of authenticity that proves you own a one-of-a-kind item in the virtual world.

The rise of NFTs

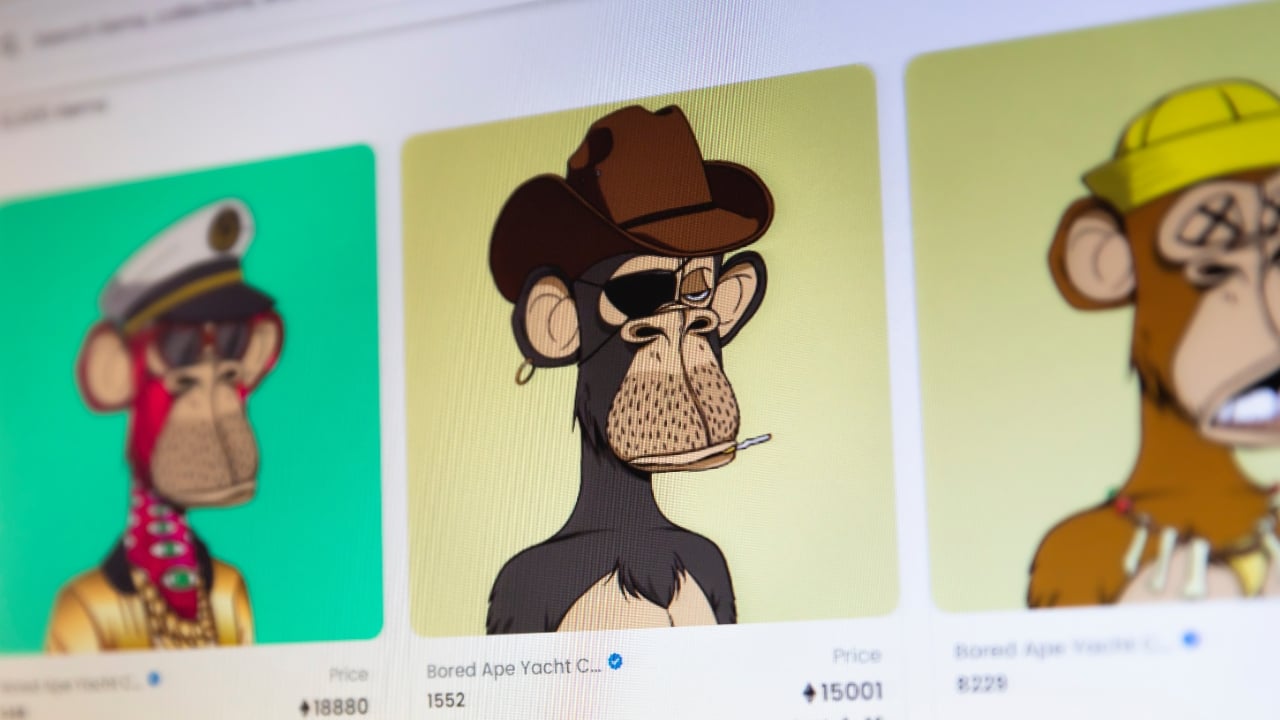

NFTs took the world by storm in 2021 following the success of NFTs like Bored Ape and Cyrptopunk, which at one point were selling for millions.

As the tokens gained popularity, celebrities were jumping on board too, and people around the world were suddenly interested in the technology.

The inception of NFTs dates back to the early 2010s when they gained significant momentum with the introduction of the ERC-721 token standard on the Ethereum blockchain around 2017. This marked a pivotal moment, enabling the creation and trading of unique digital assets.

The emergence of CryptoKitties, a blockchain-based game, showcased the potential of NFTs for digital collectables. CryptoKitties were one of the first major blockchain games, with each image being a unique non-fungible token (NFT) on the Ethereum blockchain.

CryptoKitties' popularity even caused temporary congestion on the Ethereum network due to the high volume of transactions. They are considered a one of the main early examples of NFTs and blockchain technology in a gaming context.

At the same time, high-profile NFT sales, such as Beeple's record-breaking $69 million auction, catapulted NFTs into the mainstream, cementing their status as a disruptive force in the digital token world.

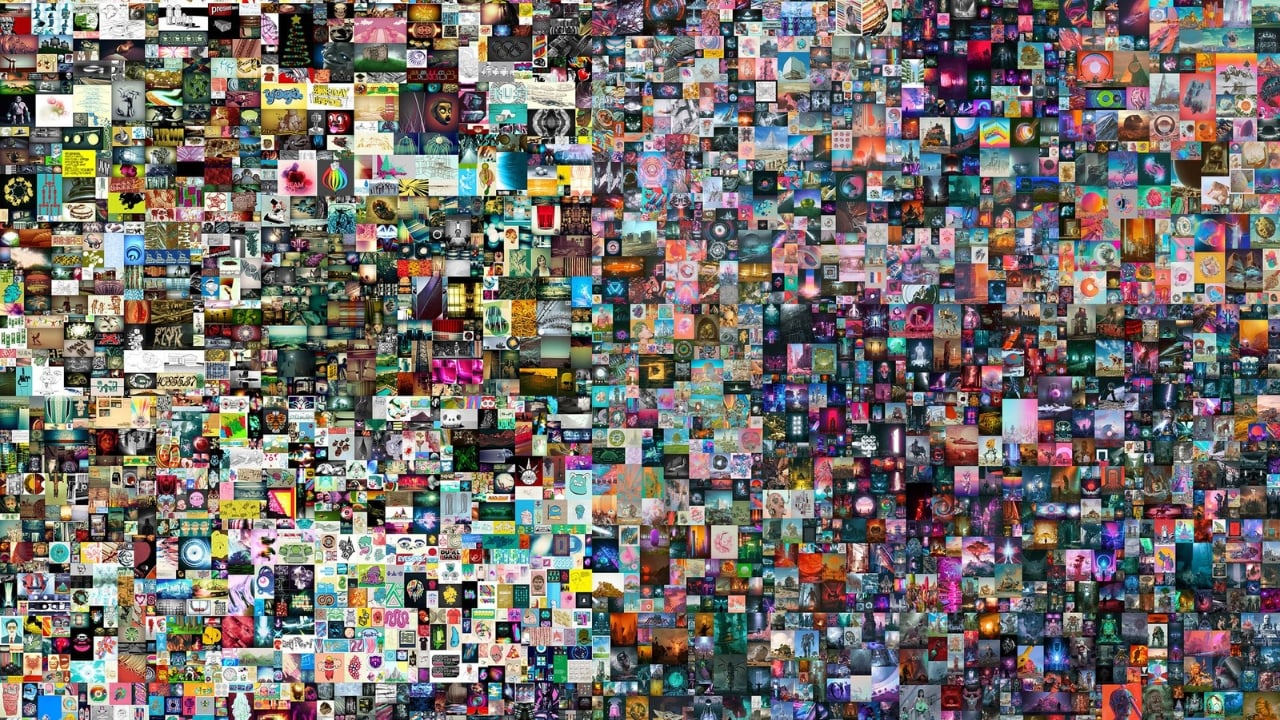

"Everydays: The First 5000 Days" was a collage of 5,000 individual digital images, each created by Beeple one day for over thirteen years. The NFT essentially functioned as a certificate of authenticity and ownership for this digital artwork.

In March 2021, digital artist Beeple (real name Mike Winkelmann) made history with the sale of his digital artwork titled "Everydays: The First 5000 Days" for a whopping $69.3 million at Christie's auction house.

It was the most expensive purely digital artwork ever sold at auction, placing Beeple among the top-selling living artists. Christie's became the first major auction house to offer a purely digital work with a unique NFT attached.

The initial excitement surrounding NFTs was fueled by a few key factors. Firstly, there was the novelty factor. People were fascinated by the idea of owning a unique digital asset, something akin to a rare trading card in the digital realm.

Secondly, the early days saw a surge in speculative buying. Investors saw potential for quick returns, driving prices up to dizzying heights. Stories of multi-million dollar sales for pixelated images and memes fueled the fire, and social media buzz and celebrity endorsements further amplified the hype.

Since then, the NFT market has expanded beyond digital art and collectables to encompass a wide range of industries and applications. It has sparked conversations about ownership, authenticity, and the value of digital assets in the Internet age. As the NFT ecosystem evolves, questions about copyright, intellectual property rights, and sustainability remain hotly debated.

Critics raise concerns about the environmental impact of blockchain technology, particularly the energy-intensive process of minting and trading NFTs on networks like Ethereum.

What is NFT Art?

Non-fungible token art represents digital creations verified as unique and authentic through blockchain technology. Unlike traditional digital files that can be easily duplicated, NFT art uses blockchain to ensure each piece is one-of-a-kind, with verified ownership and provenance. This innovation allows artists to tokenise their digital work, creating a new marketplace for buying, selling, and trading digital art.

With platforms like OpenSea, Rarible, and Foundation leading the way, NFT art has revolutionised the art world. Artists can now monetise their digital creations directly, while collectors invest in exclusive digital assets. The NFT art market has seen explosive growth, with some pieces achieving multimillion-dollar sales, highlighting the increasing importance of blockchain technology in digital art.

Most Common NFT Marketplaces?

Some of the most common NFT marketplaces include OpenSea, the largest and most diverse platform known for its wide range of digital art, collectibles, and virtual goods. Rarible is another popular choice, offering a decentralised approach with community governance and a focus on creative content. Foundation, renowned for its curated and high-quality art collections, has gained significant traction among artists and collectors alike.

Additionally, platforms like SuperRare, known for its exclusive, high-end digital art, and Zora, which offers innovative auction formats and creator royalties, provide unique experiences in the NFT space. Each marketplace caters to different needs and preferences, from general trading to niche markets, making it essential for users to explore these options to find the platform that best suits their interests and investment goals.

How to Build an NFT: A Step-by-Step Guide

Building an NFT can seem complicated, but with the right tools and guidance it's an achievable goal. In the following guide, we will walk you through the process of creating your NFTs and how to make them stand out in the digital marketplace.

1. Choose the Right Blockchain

The very first step in building an NFT is selecting the right blockchain. Popular blockchains for NFTs include Ethereum, Solana, and Polygon. Each blockchain has advantages, like gas fees, transaction speeds, and security, so choosing the one that fits your project best is essential.

2. Set Up as a Digital Wallet

You will need a digital wallet to store your cryptocurrency and NFTs. Some of the most widely used wallets for NFT creation are MetaMask, Trust Wallet, and Coinbase Wallet. After setting up your wallet, make sure you connect it to your chosen blockchain.

3. Create your Digital Art

At the heart of any NFT is the digital art you want to tokenise. Whether it is digital painting, a 3D model, or music, your content should be original and high quality/ The format of your digital asset will depend on the platform you choose to mint your NFT (JPEG, PNG, MP4, etc.).

4. Mint your NFT

Minting an NFT refers to the process of turning your digital content into a unique cryptographic asset on the blockchain. This process is done using NFT marketplaces like OpenSea, Rarible, or Mintable. Simply upload your artwork, provide the necessary details (title, description, and royalties), and mint your NFT.

5. List your NFT for Sale

Once your NFT is minted, it's time to list it for sale. You can set a fixed price or hold an auction for your NFT. Each marketplace has its set of features and guidelines for listing NFTs, so make sure you understand the marketplace fees and payment options (most platforms accept ETH or USDC).

6. Track the Performance

After your NFT is sold, tracking its performance and engaging with your community is essential. Use tools like Etherscan and DappRadar to monitor the sales and ownership transfers of your NFTs. This helps build a strong NFT brand and engage your buyers for future projects.

What Happened to NFTs?

The NFT hype cycle has well and truly died as of April 2024. The initial buying spree in 2021 was driven more by the potential for quick profits than by the actual value of the NFTs themselves. As the market became more crowded, the value of NFTs plummeted.

The value of NFTs is often tied to the value of cryptocurrency, especially Ethereum. As the crypto marketplace went through a downturn, so did the buying power for NFTs. This, paired with the decline of digital spaces like the metaverse, have meant that people simply are no longer interested in the digital token business.

Many NFTs purchased for high prices in 2021 are now worth a fraction of what they were originally sold for, with reports suggest that a large percentage of NFTs have become virtually worthless.

Here are some factors that continue to contribute to this decline:

1. Market Saturation

The initial excitement surrounding NFTs led to an explosion of projects and offerings, saturating the market with many digital assets. With thousands of new NFTs minted daily, distinguishing between projects and identifying genuine value became increasingly challenging.

As a result, investors and collectors faced decision fatigue and hesitation, contributing to a general sense of oversaturation and dilution of value within the NFT space.

2. The Death of the Hype Cycle

The euphoria and speculation surrounding NFTs gave rise to inflated prices and frenzied trading activity reminiscent of past market bubbles. However, as with any speculative bubble, reality eventually set in, leading to a price correction and a re-evaluation of the NFT market's sustainability.

The burst of the NFT bubble may have prompted investors to reconsider their positions and adopt a more cautious approach, dampening the enthusiasm that once characterised the market.

3. Copyright Issues

The NFT space has been plagued by copyright infringement and plagiarism issues, unauthorised use of copyrighted material and disputes over ownership rights.

These issues undermine the legitimacy and authenticity of NFTs, eroding trust among creators and collectors alike. As concerns about intellectual property rights persist, some individuals may be reluctant to participate in a market fraught with legal uncertainties and ethical dilemmas.

Are NFTs Dead?

While the initial frenzy surrounding NFTs has subsided, it would be wrong to declare them totally dead. Still, NFT sales have significantly dropped since their 2021 peak and many speculate that oversaturation may have killed off the non-fungible token business for good.

Although some NFTs have lost value, however, others continue to be valuable – particularly those with historical significance or strong communities. This suggests the underlying concept of digital ownership with NFTs might still hold weight.

According to the NFTEvening, in 2024, the NFT market has faced alarming trends, with 98% of 2024 NFT drops being dead, showing minimal market activity. Despite a surge in new NFT collections, only 0.2% of 2024 NFT drops generate investor profits. A staggering 64% of 2024 NFT drops have fewer than 10 minutes, and 98% see fewer than 10 trades in the first week, signalling poor liquidity.

Furthermore, 98% of 2024 NFT drops experience a price decline of at least 50% within the first three days, while 84% of drops reach an ATH price equal to the mint price, failing to sustain value over time.

Despite these challenges, the allure of NFTs persists, with new projects and innovations constantly emerging in the space. Some believe NFTs are moving beyond just art too. Projects are exploring areas like ticketing (event access), data ownership, and even gaming.

Comments ( 0 )