If you’ve ever stared at a dashboard full of “good” leads while revenue somehow stays stubborn, you’re not alone. Marketing’s generating MQLs. Sales is working SQLs. Pipeline exists. Forecasts look fine. Then deals stall, go dark, or die quietly in a quarter-end spreadsheet like they never mattered.

That’s usually not a lead volume problem. It’s a journey design problem.

In complex B2B sales, buyers don’t move in a straight line. They circle. They pause. They bring in new stakeholders late. They change priorities mid-flight because a budget owner has a different risk threshold than the person who requested the solution in the first place. If your funnel assumes one lead equals one decision-maker, your MQL to SQL process will keep producing friction, even if your targeting is solid.

The fix isn’t to abandon MQLs or SQLs. It’s to treat them as signals inside a mapped B2B lead journey, with clear handoffs and shared rules for what “ready” actually means.

Why The Traditional MQL to SQL Funnel Breaks Down In Complex B2B

The traditional funnel is tidy. It’s also optimistic.

It assumes a lead progresses because they’re interested, and they’re interested because you’ve persuaded them. In reality, most complex B2B deals move because internal consensus forms, risk feels manageable, and someone decides the cost of change is lower than the cost of staying put.

That’s a different kind of journey. More like navigating a building than walking down a corridor. Lots of doors. Lots of people with keys.

Buying groups, not individual leads, drive decisions

In complex B2B, the “lead” is often just the first visible person in what’s really a buying group. That group will usually include:

- Someone with the pain (they want relief)

- Someone with the budget (they want control)

- Someone technical (they want certainty)

- Someone operational (they want minimal disruption)

- Someone senior (they want risk reduced and outcomes defended)

Each of those people asks a different question, even when they’re looking at the same product. That’s why lead-centric scoring can get weird fast. A single person downloading a whitepaper might be curiosity, research, or preparation for a wider internal conversation. Without context, it can look like intent when it’s actually early discovery.

If your MQL definition treats “one person did a thing” as progress, you’ll keep passing leads that can’t move forward yet.

Why timing matters more than volume

A high-quality lead passed at the wrong moment can be just as damaging as a low-quality lead.

Think about how most sales teams handle a rushed handoff. They reach out. The buyer isn’t ready. The message lands flat. The lead gets marked “not responsive”. It drifts into follow-up limbo. Marketing thinks sales dropped the ball. Sales thinks marketing sent junk.

What actually happened is that the organisation mistimed the conversation. The buyer might still be interested, but they’re not ready to engage with a seller. Or they are ready, but the seller doesn’t have enough context to be relevant.

In a complex B2B sales cycle, relevance is timing plus insight. If either one is missing, the journey resets.

Redefining MQL And SQL For Modern B2B Journeys

Most teams don’t need new funnel stages. They need better definitions. Specifically, definitions built around readiness and context, not activity.

Here’s a useful way to reframe it:

- An MQL is a sign that marketing has found a meaningful signal.

- An SQL is a sign that sales can add value right now.

Those two ideas sound simple. They also change everything.

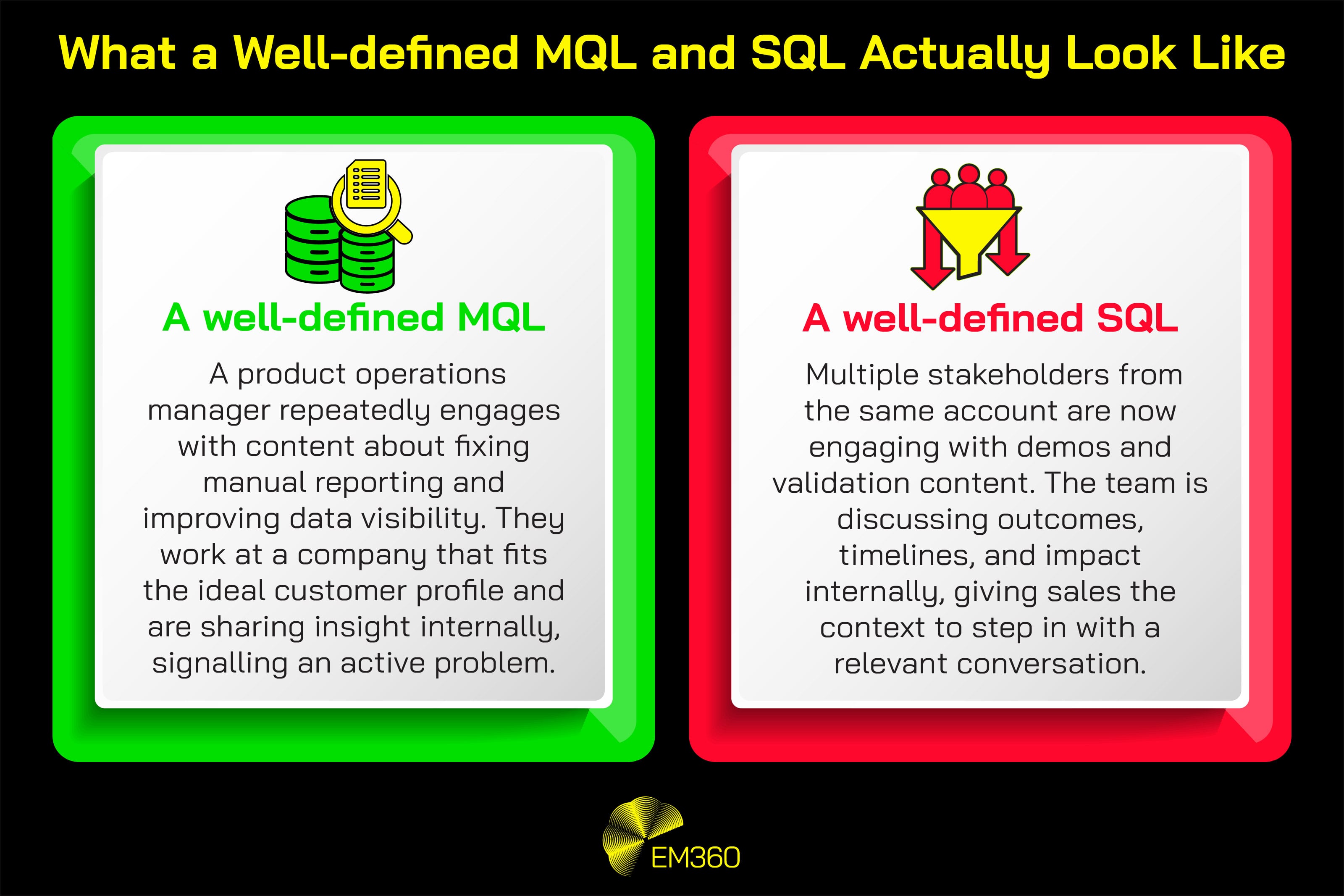

What an MQL actually needs to signal today

A modern marketing qualified lead (MQL) shouldn’t be “someone who downloaded something”. It should be “someone whose behaviour suggests a relevant problem, and whose role makes that problem actionable”.

That usually means your MQL definition needs more than one signal. Not more complexity, just more truth.

Strong MQL signals often include a combination of:

- Repeated engagement around the same problem area (not scattered curiosity)

- Engagement that shows evaluation behaviour, not just learning behaviour

- Role relevance (the content matches what their job typically influences)

- Early evidence of internal sharing or multi-person interest, if you can see it

- A clear fit with your ideal customer profile (ICP), not just a warm body

The keyword here is engagement signals. Activity is cheap. Patterns are meaningful.

If you’re mapping the lead journey properly, your MQL is an early waypoint. It’s not a finish line.

When an SQL is truly sales-ready

A modern sales qualified lead (SQL) is less about “they hit a score” and more about “sales can have a real conversation without forcing it”.

That usually requires three things:

- First, the buyer has enough problem awareness to talk about outcomes, not features.

- Second, there’s some sign of internal momentum. That doesn’t mean budget is approved. It means the conversation exists beyond one person’s head.

- Third, sales has enough context to be relevant. Without this, even a keen buyer can be turned off fast.

This is where sales readiness becomes practical instead of theoretical. If your sales team’s first call feels like a cold discovery call, you’ve probably qualified too early. If your sales team is constantly reacting late, you’ve probably qualified too late.

Either way, it’s a journey mapping issue.

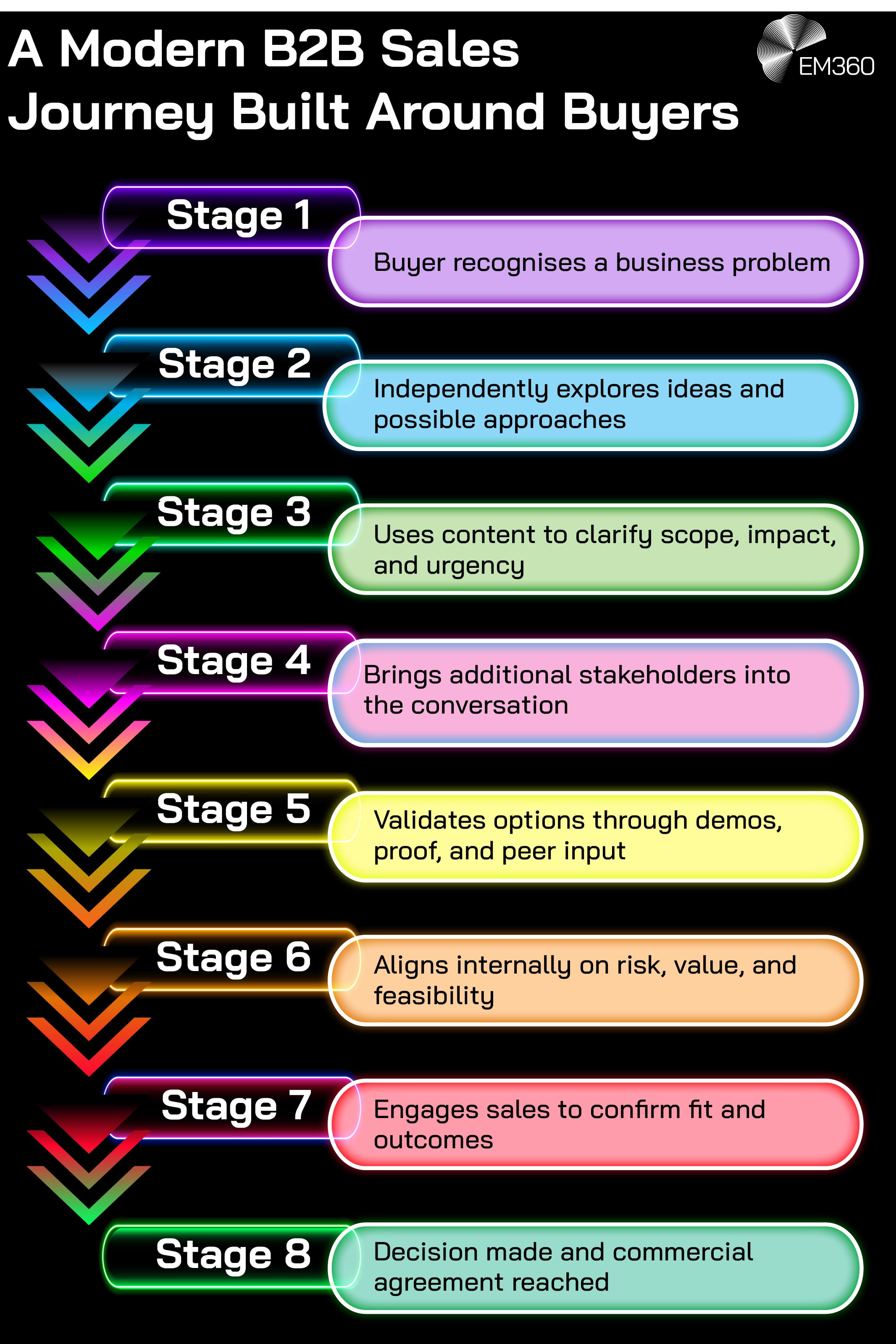

Mapping The Lead Journey From First Signal To Closed Deal

Journey mapping is just agreeing on reality, in a format people can use.

A useful lead journey map answers four questions at every stage:

- What does the buyer need right now?

- What does the business need to know right now?

- Who owns the next move?

- What is the expected output of this stage?

If you can’t answer those clearly, your handoffs will always feel like guesses.

Here’s a clean way to map the journey without turning it into a spreadsheet monster.

Early discovery and intent signals

This stage is where buyers surface before they fill in forms. They’re researching. Comparing. Testing language. Looking for proof that they’re not missing something obvious.

This is also where marketing can do its best work, because buyers are still shaping their understanding of the problem.

The practical goal in early discovery is to capture buyer intent without forcing a sales conversation too soon. That usually means focusing on:

- Problem clarity content: what’s happening, why it matters, what’s at risk

- Comparison clarity content: categories, approaches, trade-offs

- Credibility signals: proof points, real outcomes, peer validation

If you’re using intent data, treat it like a compass, not a verdict. Intent doesn’t mean “ready to buy”. It means “pay attention”.

Your key output in this stage is a clear, evidence-backed reason to keep the buyer engaged and to deepen your understanding of fit.

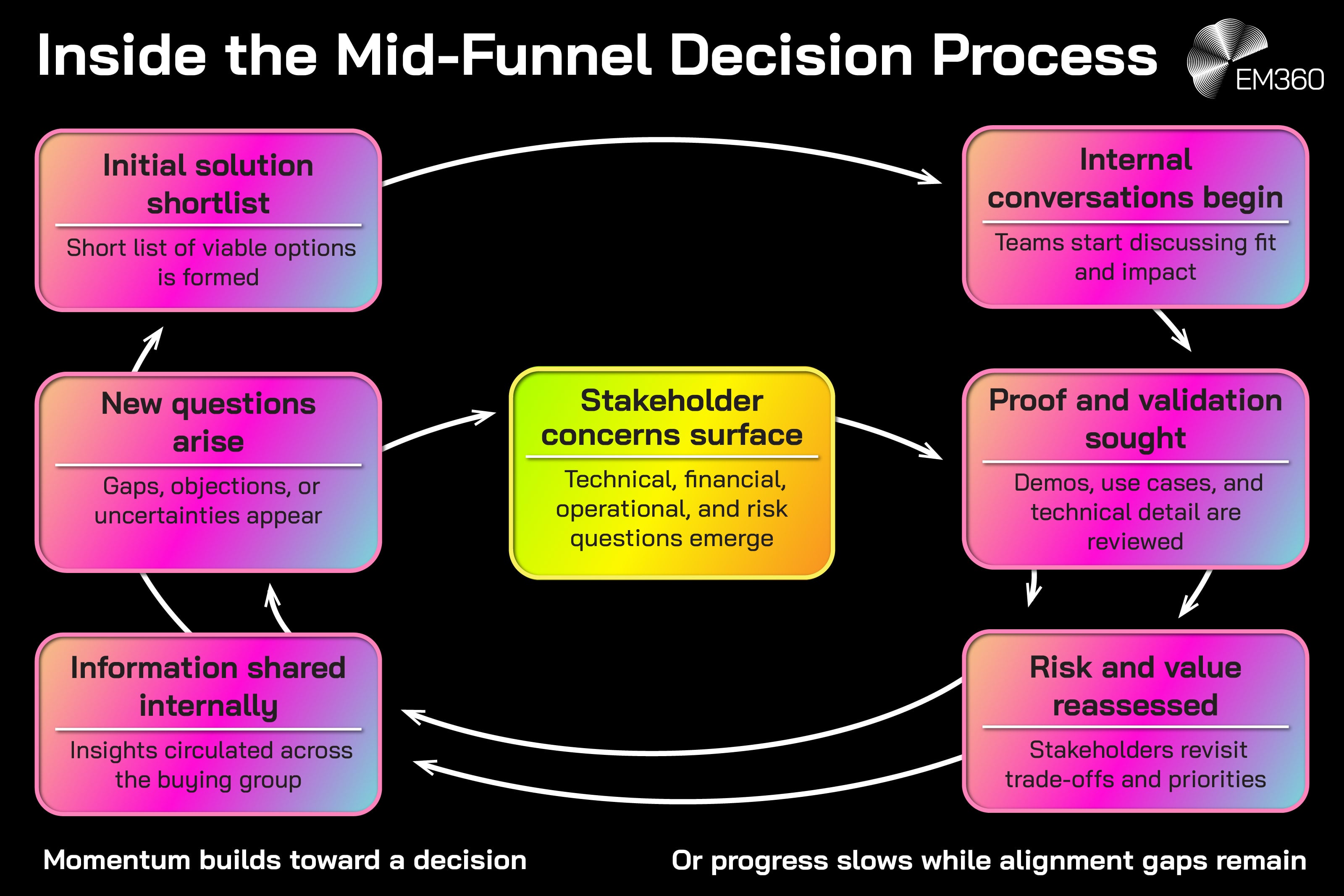

Mid-funnel validation and internal alignment

This is where the neat funnel stops being neat.

Buyers start validating. They bring in technical stakeholders. They ask sharper questions. They begin testing risk: security, compliance, integration effort, time-to-value, organisational disruption.

In this stage, marketing and sales both matter. Marketing supports confidence. Sales supports decision-making. The problem is that many teams still treat this stage like a simple pass-through: marketing hands over, sales takes over.

That’s not how it works.

Mid-funnel is where you need shared coverage. Not duplicated coverage. Shared.

What marketing should enable here:

- Clear proof points tied to outcomes and constraints

- Objection-ready content that speaks to different stakeholder fears

- Narrative continuity so the buyer doesn’t feel like they’re starting again

What sales should add here:

- Sharp qualification that respects the buyer’s maturity

- Personalised framing based on what’s already known

- Direct help with internal alignment (who needs what to say yes)

If you want a simple check, ask this: when the buyer moves from marketing-led engagement to sales-led engagement, does it feel like progression, or does it feel like repetition?

Repetition kills momentum.

Late-stage decisioning and deal momentum

Late stage is where buyers become allergic to uncertainty. Not because they’re difficult, but because they’re close enough to owning the decision that the cost of being wrong is now personal.

This is also where hidden stakeholders appear. Someone senior asks one hard question. Someone legal wants one clause changed. Someone finance wants to see cost framed differently. Someone in security wants assurance that the solution won’t become their next incident.

Your job, as a business, is to protect momentum without pushing. It’s a balancing act.

The outputs that matter most here are:

- Clear next steps that feel safe, not pressured

- Risk reduction materials that match real stakeholder concerns

- Internal alignment support, especially when the buyer is trying to persuade people who haven’t been part of the journey so far

If your journey map ends at “proposal sent”, you’re going to keep losing deals in the quiet space after that moment. The journey still exists. You just can’t see it unless you’ve designed for it.

Marketing And Sales Handoffs That Actually Work

Most handoff problems aren’t caused by bad intentions. They’re caused by missing structure.

A clean lead handoff answers the question, “What does the next person need to know so they don’t reset the relationship?”

That’s it. That’s the standard.

What marketing must pass to sales

Sales doesn’t need every click. They need the story.

At minimum, a marketing-to-sales handoff should include:

- What the buyer has shown interest in, in plain language

- The pattern of engagement (what keeps repeating, what seems urgent)

- Any signals of multiple stakeholders, if available

- The buyer’s likely role and influence level

- The most likely next question the buyer will ask

This is where lead context stops being a nice-to-have and becomes a performance issue. When sales has context, their first message can sound like it belongs in the conversation that’s already happening.

That’s how you protect momentum.

What sales must feed back to marketing

Marketing can’t improve what it can’t see.

If sales takes leads and never returns information, marketing is forced to optimise for the wrong outcomes. It becomes a loop of “more leads” instead of “better progression”.

Sales feedback should include:

- Lead disposition that’s specific enough to learn from

- Why the lead wasn’t ready, if that’s the case

- What objection or gap blocked progress

- What kind of content or proof would’ve helped

- What patterns sales is seeing across the pipeline

This is the difference between “alignment” as a meeting topic and alignment as an operating system.

Designing The Journey Around How Buyers Actually Buy

A buyer doesn’t experience your funnel stages. They experience their own decision-making process.

If your internal process forces buyers to do emotional labour, like repeating themselves, justifying everything, or navigating disjointed messaging, they’ll slow down or disengage. Not because they don’t want the solution, but because the journey feels heavy.

A buyer-centric journey reduces cognitive load. It makes the next step feel obvious and safe.

Using intent, content, and engagement as journey signals

A mapped journey works best when it’s observable. You need signals you can actually act on.

That’s where intent data, content engagement, and self-serve product experiences can help. Not as magic predictors, but as practical indicators of where buyers might be.

A simple way to use these signals is to sort them into three buckets:

- Learning signals: “I’m trying to understand the space.”

- Evaluation signals: “I’m comparing options and testing fit.”

- Decision signals: “I’m trying to reduce risk and justify a choice.”

When your team can agree which bucket a buyer is in, your messaging becomes calmer and sharper. Marketing doesn’t overheat. Sales doesn’t underdeliver. The journey holds.

Avoiding false SQLs and stalled deals

False SQLs aren’t “bad leads”. They’re leads passed into sales without the conditions required for progress.

They usually happen when:

- A score threshold becomes more important than readiness

- Handoff context is thin, so sales can’t be relevant

- Internal buying group dynamics are invisible and ignored

- The team confuses interest with commitment

The solution isn’t to tighten the gate until nothing gets through. That just starves pipeline. The solution is to strengthen the map.

When you map the journey properly, you can route leads into the right next step instead of forcing every lead into a sales conversation. Some need nurturing. Some need stakeholder support. Some need proof. Some need time.

A journey map gives you permission to act like you understand that.

Final Thoughts: The Lead Journey Is A Revenue System, Not A Funnel

A funnel is a diagram. A lead journey is a living system.

When you map the journey properly, MQLs and SQLs stop being labels you argue about and start becoming useful signals that guide the next move. Marketing knows what it’s building toward. Sales knows what they’re stepping into. Buyers feel carried instead of chased.

That’s the difference between pipeline that looks healthy and revenue that actually lands.

If you’re tightening up your MQL to SQL motion, or you’re trying to reduce deal stalls without burning out your team, it’s worth starting with the map. And once that’s done, EM360Tech can help you deliver leads into it with the context needed to keep the conversation moving, right through to the close.