If your ideal customer profile still starts and ends with company size, sector, and geography, it's probably telling you more about how you want to sell than how enterprises actually buy.

That gap is getting expensive. Tech-service providers are seeing it in the form of long sales cycles, stalled deals, and “great leads” that never turn into revenue. It's not because the market has disappeared. It's because buying has changed, and the modern ideal customer profile has to change with it.

In 2026, “ideal” is less about whether an account could use your service and more about whether it can buy it. That means mapping reality: how buying groups behave, how consensus is reached (or not), how preference forms before a vendor is contacted, and whether your targeting model can still function as privacy and data signals evolve.

Why Traditional ICPs Are No Longer Fit for Purpose

A lot of ICPs were built for a simpler moment. They were designed to help teams focus, not to predict outcomes. Today, the cost of being “broad but busy” is higher, and the margin for irrelevant outreach is thinner.

Firmographics alone no longer predict revenue outcomes

Firmographic data can still be useful, but it's not enough. Two companies that look identical on paper can behave completely differently once buying starts. One has clear ownership, budget pathways, and change capacity. The other has endless stakeholders, unclear priorities, and a history of stalled transformation.

This is why many tech-service providers feel like they're doing everything “right” and still missing the target. The ICP said the account fit, the funnel filled, and the pipeline built, and then the deal evaporated into internal complexity.

A modern ICP has to separate surface-level fit from the conditions that make a purchase possible.

Single-persona targeting breaks in committee-led buying

If you build your targeting around a single champion, you're betting that one person can pull a decision through a complex organisation. That’s a risky bet in 2026.

Gartner’s data shows how fragile consensus can be: 74 per cent of B2B buyer teams demonstrate unhealthy conflict during the buying decision process, meaning stakeholders disagree on objectives, priorities, and the “right” path forward.

That's not a messaging issue. It's a buying system issue. If your ICP doesn't account for stakeholder alignment, you will keep targeting accounts that can start conversations but can't finish decisions.

The 2026 ICP Shift From Fit to Readiness

The strongest ICPs now behave more like decision filters than audience descriptions. They identify accounts with the structural conditions to move from interest to purchase.

Buying readiness matters more than theoretical fit

Readiness is not hype, and it's not just about “intent scores”. It's a practical question: is this organisation in a position to act?

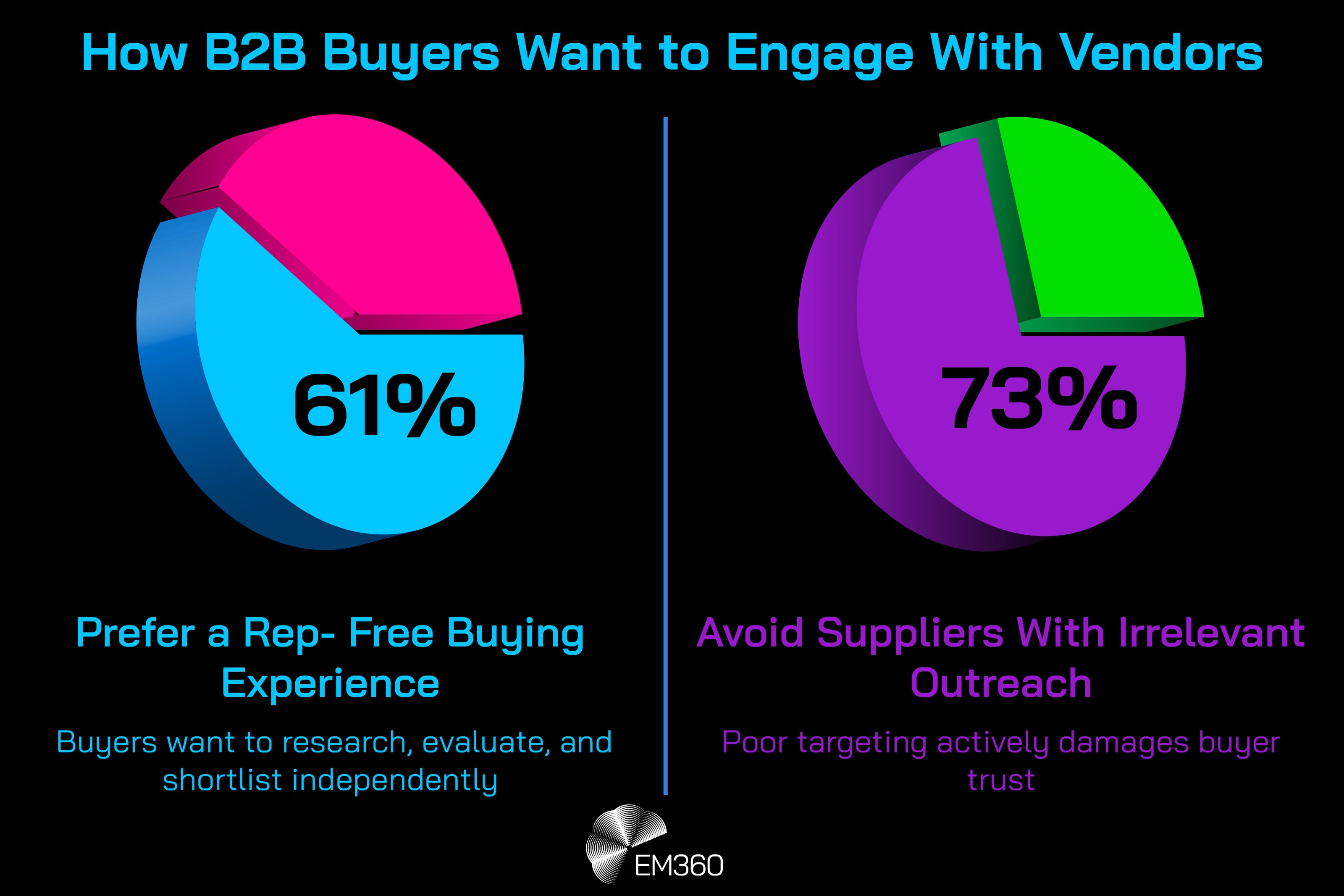

Gartner’s sales research is a useful signal here because it shows what buyers are punishing. In its June 2025 survey of 632 B2B buyers, 61 per cent said they prefer a rep-free buying experience, and 73 per cent said they actively avoid suppliers who send irrelevant outreach.

That combination changes the job of your ICP. You're not just deciding who to target. You're deciding who you can engage in a way that is relevant, welcome, and timed to genuine need. That's why buying readiness becomes a defining feature of modern ICP work.

Practical readiness signals you can build into an ICP definition include:

- Evidence of a business trigger (new compliance requirement, platform migration, post-incident remediation, growth inflection)

- Clear ownership for the capability you deliver (not just a title, but a function with authority)

- Prior investment patterns that suggest the problem is funded, not theoretical

Preference is often formed before vendors engage

By the time many buyers talk to a vendor, they're not starting a search. They're validating a shortlist.

The 6sense B2B Buyer Experience Report for 2025 puts numbers behind this shift. Buyers evaluate an average of 4.5 vendors, buying groups average 10+ members, and the typical journey takes nearly a year. Most importantly, 95 per cent of buyers in 2025 ultimately purchase from one of the four vendors on their “Day One” shortlist.

If you're not designing your ICP to help you earn a place on that shortlist early, you're designing it to lose slowly and politely.

This is where modern ICPs start to include “influence conditions”, not just fit conditions. Where do these accounts learn? Who do they trust? What proof do they need to see before they ever respond?

Buying Group Reality Must Be Baked Into the ICP

A modern ICP is not a list of accounts. It's a model of how a buying group inside those accounts will behave, what risks will stall them, and what evidence will move them forward.

ICPs need to define who must agree, not just who signs

Enterprise buying is rarely a straight line between a problem owner and a signature. It's usually a negotiation between functions: security, procurement, legal, IT, finance, and the business unit that will live with the outcome.

That means your ICP needs to describe the functional map, not just the job title. You're looking for patterns like:

- A defined security or risk gate that matches your delivery model

- A procurement function that can contract for services at your price point

- A clear operating owner for implementation and change

This is where the buying group becomes part of the ICP itself. If you can't identify a realistic path to internal agreement, the account is not “ideal”, even if it's huge.

Internal alignment risk is a qualification signal

One of the most common mistakes in B2B segmentation is treating friction as a late-stage sales problem. In reality, friction is often visible early if you know what to look for.

Gartner’s finding on unhealthy conflict is not just an interesting stat. It's a warning that internal misalignment is normal, and your ICP should favour accounts with better odds of reaching consensus.

In practice, alignment risk shows up as:

- Competing owners for the same initiative

- No agreed definition of success

- A history of stalled transformation projects

- Security and IT functions that act as blockers because trust is low

A modern ICP includes a way to detect those conditions early, even if it's a simple internal checklist used by sales and marketing together.

Data, Privacy, and Addressability Are Now ICP Constraints

You can build the smartest ICP in the world and still fail if you can't activate it. Reachability has become part of “ideal”.

First-party and partner data now define ICP viability

B2B targeting is moving away from “we can find anyone” and toward “we can find the right people in the right way”. That's why first-party data is no longer a nice-to-have. It's the foundation for accurate segmentation, attribution, and sustainable demand generation.

The IAB’s State of Data 2025 report describes how signal deprecation has driven an industry-wide shift toward first-party data, alternative IDs, and data clean rooms.

For tech-service providers, the implication is clear: accounts are not truly targetable if you can't validate and engage them through consented, reliable signals. The ICP has to be designed around the data you can actually use, not the data you wish existed.

Privacy-safe activation shapes who is realistically targetable

Google’s approach to third-party cookies continues to evolve, but the direction of travel is not ambiguous: targeting and measurement are being pressured by privacy expectations, regulation, and platform policy.

Reuters reported that Google opted out of a new standalone prompt for third-party cookies and would maintain existing settings. Reuters also reported that the UK Competition and Markets Authority said Google’s earlier commitments were no longer needed given Google’s change in approach.

You do not need to be a privacy specialist to feel the impact. You just need to run a pipeline review and notice what is harder than it used to be: attribution confidence, audience quality, and consistent signal across channels. This is why privacy-safe targeting belongs inside modern ICP thinking, especially for service providers that rely on high-quality, account-led engagement.

Thought Leadership Has Become an ICP Lever

When buying is committee-led and preference forms early, credibility is not decoration. It's infrastructure.

Hidden buyers influence outcomes even when unseen

Some of the most influential people in an enterprise decision never take the meeting. They shape the decision through internal conversations, risk warnings, and informal recommendations.

LinkedIn’s research write-up from September 2025 reports that 64 per cent of target buyers and 63 per cent of hidden buyers spend more than an hour per week consuming thought leadership. It also reports that 41 per cent of target buyers and 35 per cent of hidden buyers say a C-suite executive encouraged them to consider a vendor after engaging with that vendor’s thought leadership.

This is the practical reason hidden buyers matter for ICP design. If you only target the visible decision-makers, you're ignoring the audience that often shapes internal momentum.

ICPs should reflect where influence actually happens

A modern ICP should include “influence access” criteria. Where do these accounts look for reassurance? What ecosystems shape their trust?

For tech-service providers, those influence pathways often include:

- Peer networks and practitioner communities

- Analyst conversations and industry research

- Credible publications and event circuits

- Internal stakeholders who use thought leadership as “proof” to align others

When your ICP accounts for those realities, your content and outreach stop feeling like noise. It becomes a useful signal in a crowded buying environment. That's why thought leadership now functions as an ICP lever, not just a brand goal.

Common ICP Mistakes Tech-Service Providers Still Make

Most ICP mistakes come from confusing activity with progress.

- Confusing “largest accounts” with “best accounts”

- Big logos can be slow, political, and structurally misaligned with services delivery. Size is not a proxy for likelihood to buy.

- Big logos can be slow, political, and structurally misaligned with services delivery. Size is not a proxy for likelihood to buy.

- Treating intent tools as ICP replacements

- Intent can highlight interest. It can't guarantee readiness, consensus, or delivery fit. Use intent to prioritise within an ICP, not to define it.

- Intent can highlight interest. It can't guarantee readiness, consensus, or delivery fit. Use intent to prioritise within an ICP, not to define it.

- Optimising for leads instead of learning

- If you're not closing the loop between marketing signals, sales outcomes, and delivery reality, your ICP will drift. Good ICPs are updated by evidence, not opinion.

A modern ICP is not a document you perfect once. It's a decision system you refine as buying behaviour shifts and your market teaches you what “ideal” really looks like.

What a 2026-Ready ICP Looks Like in Practice

A practical modern ICP is short enough to use but specific enough to filter hard. It should help a marketing leader and a sales leader reach the same conclusion about whether an account deserves focus.

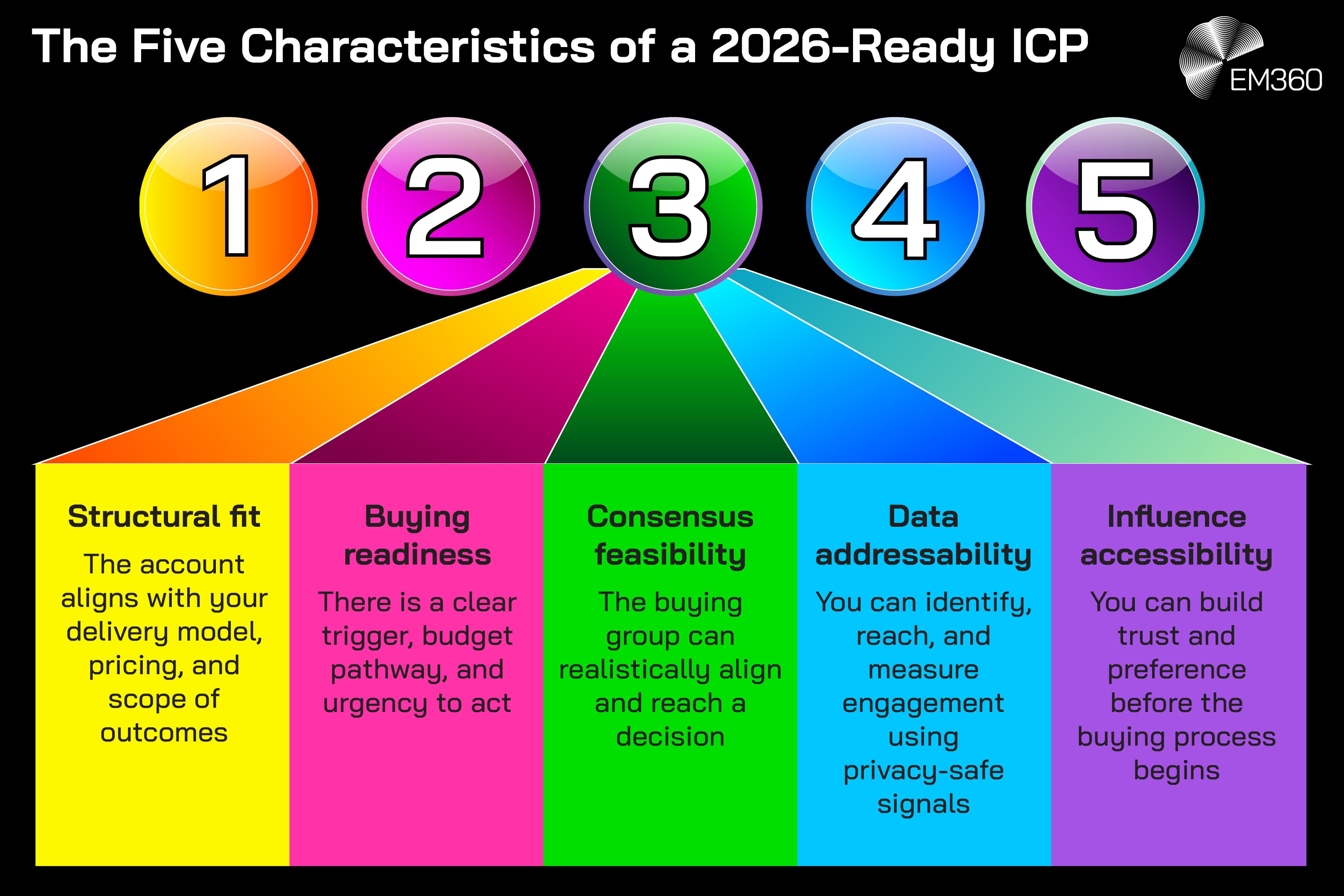

A strong 2026-ready ICP typically includes five defining characteristics:

- Structural fit – The account matches your delivery model, pricing reality, and outcome scope. Not “could use it”, but “will benefit from it in a measurable way”.

- Buying readiness – There is a credible trigger, budget pathway, and urgency window that supports action.

- Consensus feasibility – You can identify a plausible route to internal agreement across functions. If the buying group is likely to fracture, the account is not ideal.

- Data addressability – You can reach the right stakeholders through consented channels, validate engagement, and measure progress without relying on fragile assumptions.

- Influence accessibility – You can credibly build preference early, before the shortlist calcifies. This is where your proof, reputation, and content ecosystem matter.

This is not theory. It's a working go-to-market strategy filter. If an account fails two or three of these, it might still buy one day, but it should not sit at the centre of your pipeline plan.

Final Thoughts: Ideal Customers Are Defined by Buying Reality, Not Market Potential

The modern ICP for 2026 is not a prettier segmentation slide. It's a practical operating model that reflects how enterprise decisions actually happen. If your ICP doesn't account for readiness, buying-group dynamics, data constraints, and influence pathways, it will keep pointing you toward accounts that look good and go nowhere.

The teams that win in 2026 will treat ICP work as revenue design, not targeting admin. They will focus less on who could buy and more on who can buy, who will buy, and what evidence will move a buying group from uncertainty to commitment.

If you want your ICP to hold up under real buying pressure, EM360Tech’s lead generation content and programmes are built to help tech-service providers align targeting with behaviour, sharpen account focus, and turn early influence into measurable demand that sales can actually convert.